Most financial advisors enter the industry with a passion for helping clients make intelligent financial decisions and achieve their goals. They aspire to be great advisors, providing expert guidance and support.

As they succeed, however, they often find themselves stepping into an unexpected and perhaps unwanted role: the accidental CEO. Advisors who initially focused only on client relationships and financial planning must now also lead, manage and motivate a team of people.

That transition brings new challenges that require a different set of problem-solving skills and a strategic approach to leadership. What’s more, the journey from financial advisor to effective team leader is typically not accompanied by formal management training—leaving these accidental CEO advisors with a lack of clarity.

However, mastering these new responsibilities is crucial. In today’s hypercompetitive wealth management world, the people you surround yourself with will have an enormous impact on the level of success you and your practice ultimately reach. That means building and leading a high-performing team is not a luxury—it’s a necessity in ensuring that your clients and your practice thrive.

Indeed, transforming from financial advisor to visionary leader is an opportunity for unparalleled personal and professional growth—a call to build and lead a dream team that delivers exceptional results. By embracing this role, you can enhance your practice and foster a collaborative and motivated team environment that propels everyone toward more significant achievements.

The good news: There is a framework that can empower you to build a dream team of people who co-elevate each other and work as one to propel your practice to new heights.

The Power Of Advisors’ Teams

By leveraging team members’ diverse skills, advisors can provide more comprehensive solutions, faster response times and tailored approaches to meet clients’ unique needs.

Indeed, it’s almost impossible to overstate the value that a team-based approach brings to many advisory practices’ key performance indicators. For example:

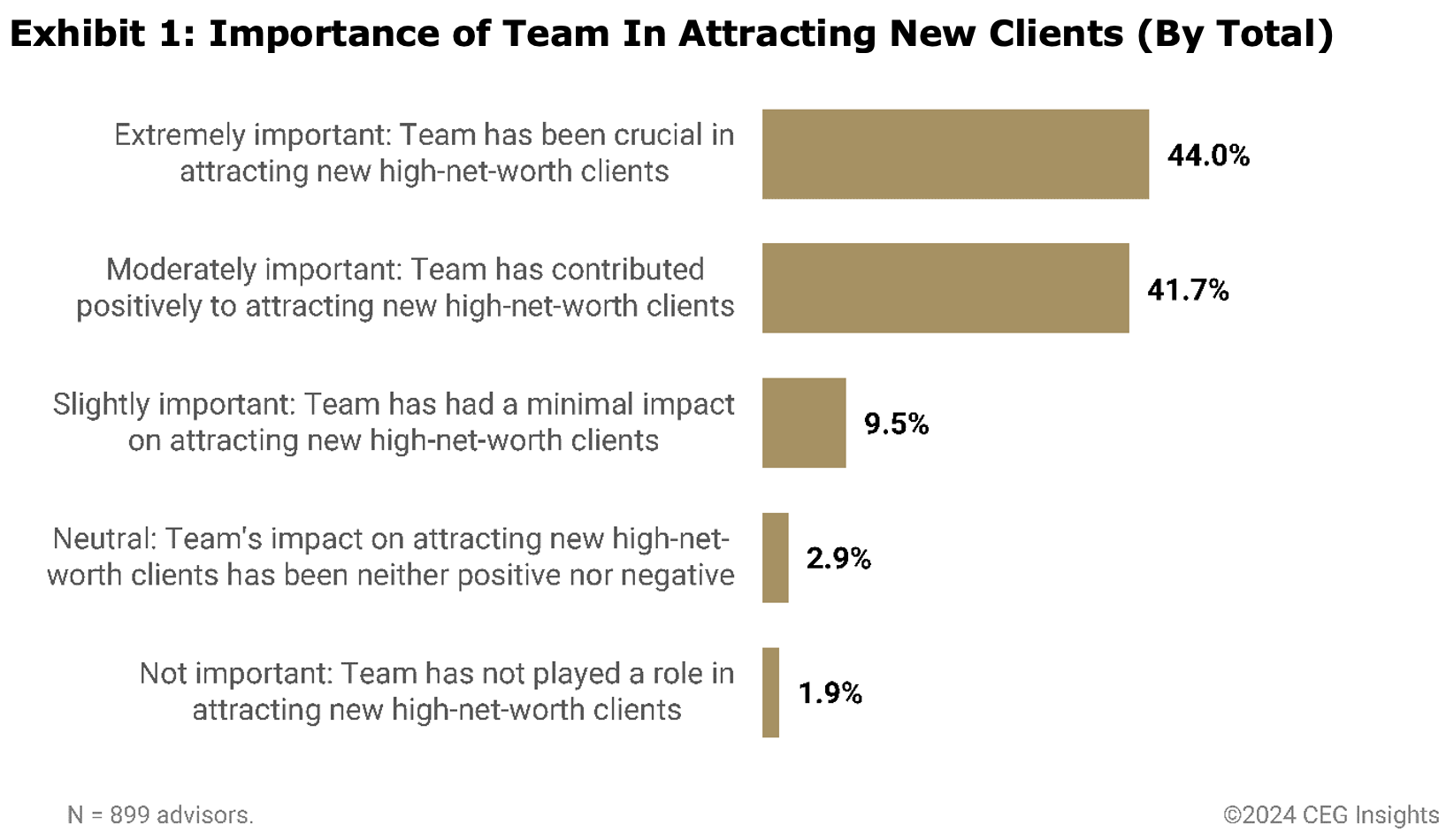

1. New clients. More than 90% of advisors surveyed by CEG Insights believe their team has positively influenced their business development efforts, with 50.5% reporting a significantly positive impact. Furthermore, 85% of advisors recognize their team’s crucial role in attracting new affluent clients, with 44% calling their team extremely important in acquiring new high-net-worth clients (see Exhibit 1).

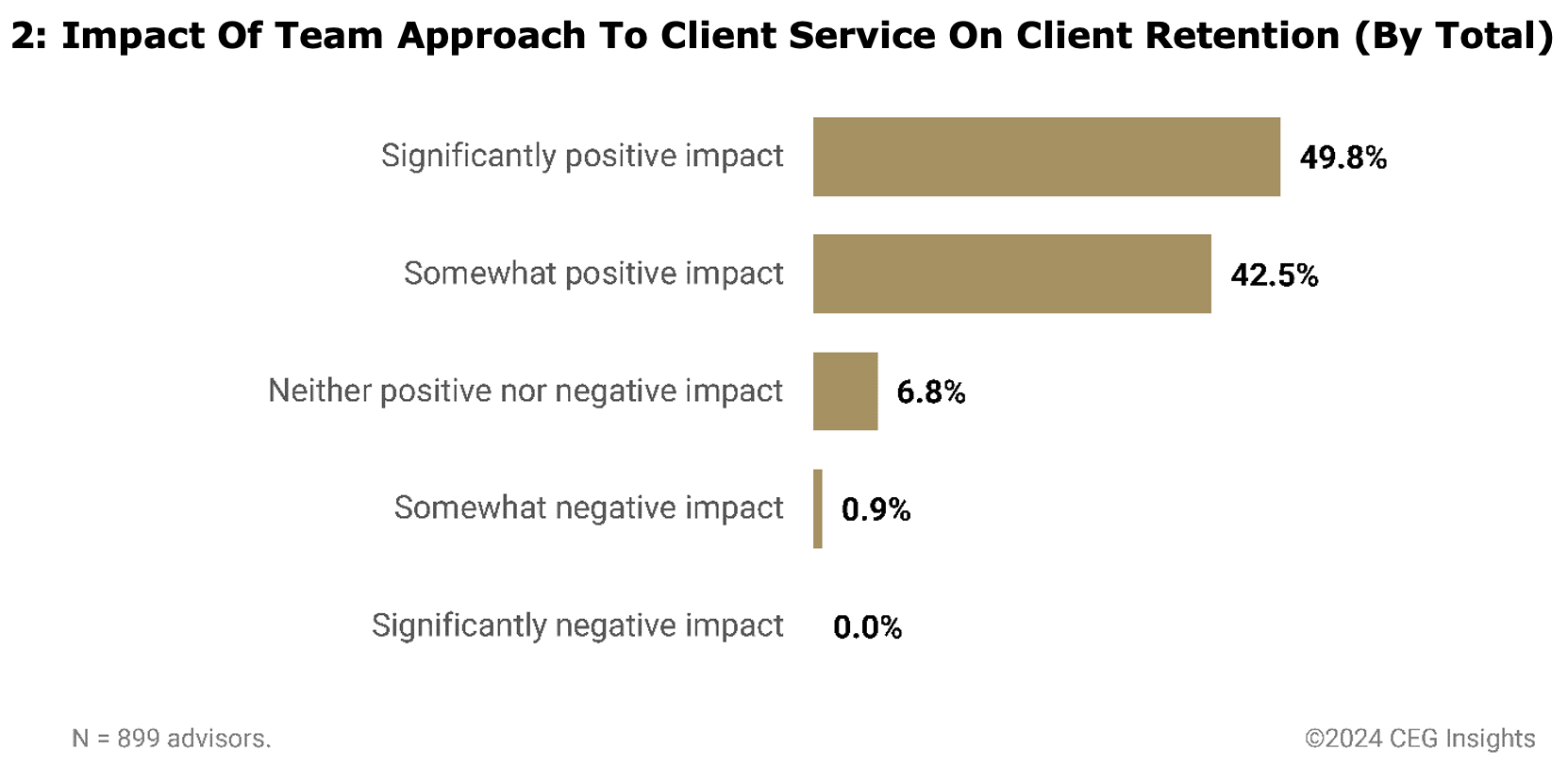

2. Client retention. A team-based approach can be instrumental in driving better client service and higher client retention. Example: A full 92.3% of advisors say that their team approach to client service has either somewhat improved or significantly improved their client retention rate (see Exhibit 2). This highlights the power of collaboration in fostering long-term client relationships and driving the overall success of advisory practices.

Urgent Team Challenges To Solve Today

These findings could easily cause advisors to conclude that their current teams of people are firing on all cylinders—working in close collaboration to expertly implement a world-class service experience that both attracts and delights highly desirable affluent clients.

Unfortunately, that is not the case.

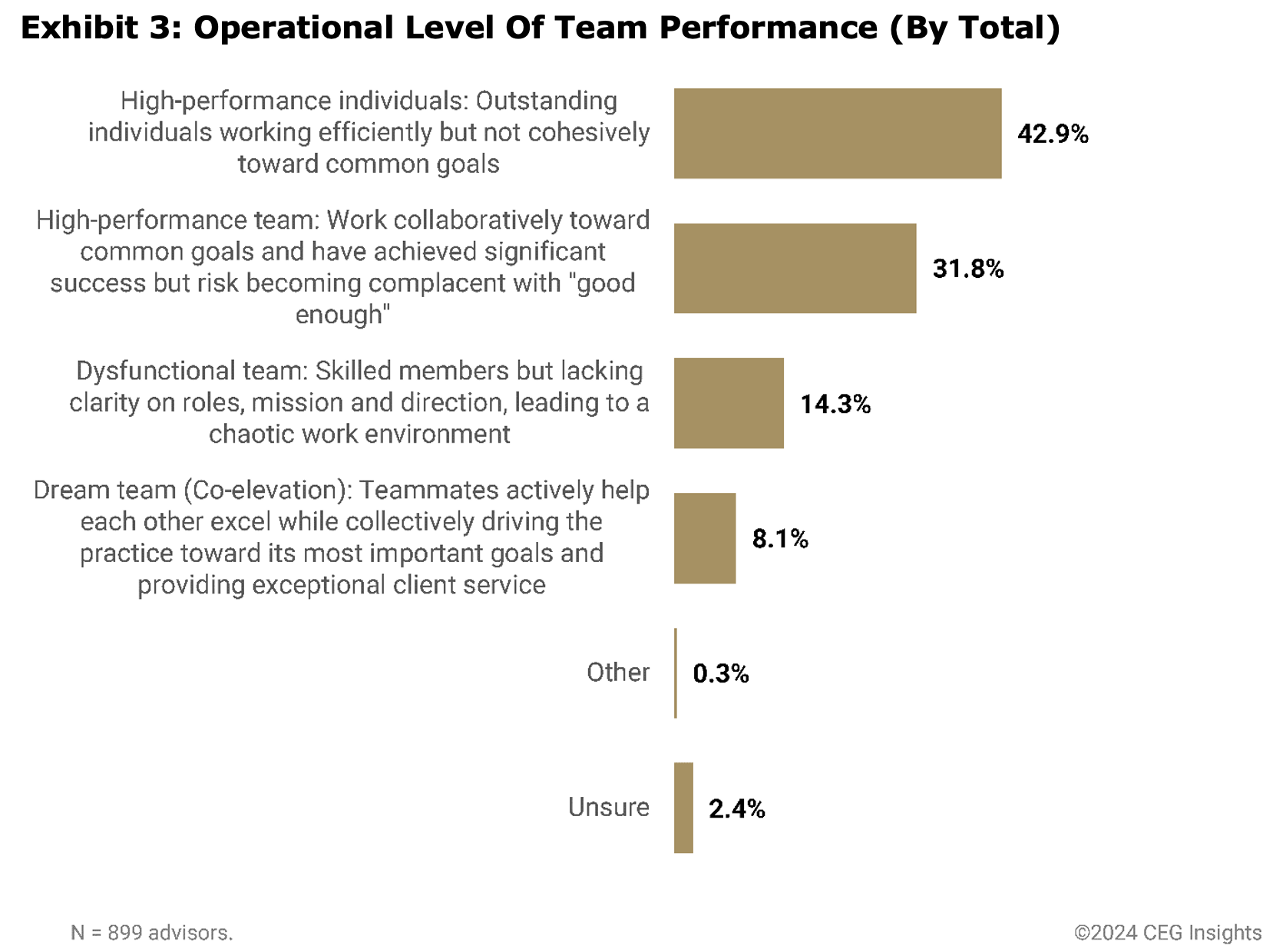

CEG Insights research reveals a clear and urgent need for a strategic transformation in many advisory teams’ operations. For example, as seen in Exhibit 3:

• A full 42.9% of advisors report that they have outstanding people on their teams, but that those individuals lack the necessary cohesion as a group to work effectively toward shared objectives. This shows a concerning disconnect between individual talent and collective performance—which highlights the importance of fostering a collaborative and goal-oriented team culture.

• Another 31.8% of advisors report strong team collaboration toward common goals—but they worry about complacency creeping into their teams.

• 14.3% of advisors actually categorized their teams as dysfunctional and chaotic.

• The percentage of advisors who say their teams are operating at the highest possible level—meaning that teammates actively help each other excel while also driving the practice toward its overarching goals—is a mere 8.1%.

The data illuminates a stark reality: Team dysfunction is notably prevalent, and truly cohesive and high-performing teams are exceptionally rare. These suboptimal levels of team performance are having a very real impact on the health and success of many advisory practices. Consider:

• 42.9% of advisors report significant losses in assets under management due to team member behavior.

• 39.2% of advisors report a significant loss of revenue due to the actions of a team member.

While it is somewhat encouraging that the majority of advisors haven’t reported such losses due to their people, there are far too many advisors who are suffering negative consequences due to problems with their teams.

Future Team Challenges To Address

Your team’s cohesion and effectiveness also matter when it comes to an issue that may be of great importance to you down the road: transition planning to ensure the long-term success and continuity of your practice.

Transition planning is a crucial aspect of future-proofing your business and ensuring that your clients’ needs are met seamlessly, even in the face of unexpected changes or the eventual transition of leadership. By proactively addressing succession planning, you can minimize disruption to your clients and maintain the trust and confidence they have placed in your team.

CEG Insights’ research reveals that while 20.9% of advisors don’t expect to transition out of their practice for at least ten years, a significant portion of advisors are facing more immediate transitions. Ten percent of advisors indicate they’ll be transitioning from their practice within the next one to two years, while a third of advisors plan to transition in the next three to five years.

These findings emphasize the pressing need for advisors to prioritize transition planning as an integral part of their team’s long-term strategy. By developing a clear succession plan, identifying and grooming potential future leaders, and communicating openly with clients about the transition process, advisors can ensure a smooth and successful transfer of responsibilities.

Effective transition planning not only safeguards the continuity of your practice but also demonstrates your commitment to your clients’ long-term financial well-being. It reassures them that their needs will continue to be met with the same level of expertise, care and attention they have come to expect.

Moreover, incorporating transition planning into the approach you take with your team can serve as a powerful tool for attracting and retaining top talent. By providing a clear path for growth and advancement within your practice, you can foster a sense of loyalty and commitment among your team members—better ensuring the long-term stability and success of your dream team.

Building A Dream Team: Leveraging Three Levers And Nine Accelerators

As a financial advisor, you can transform your practice by harnessing the collective strengths of your team members to create a dream team. By fostering a culture of collaboration, shared goals and continuous growth, dream teams drive exceptional organic growth, deliver unparalleled client experiences and secure long-term success.

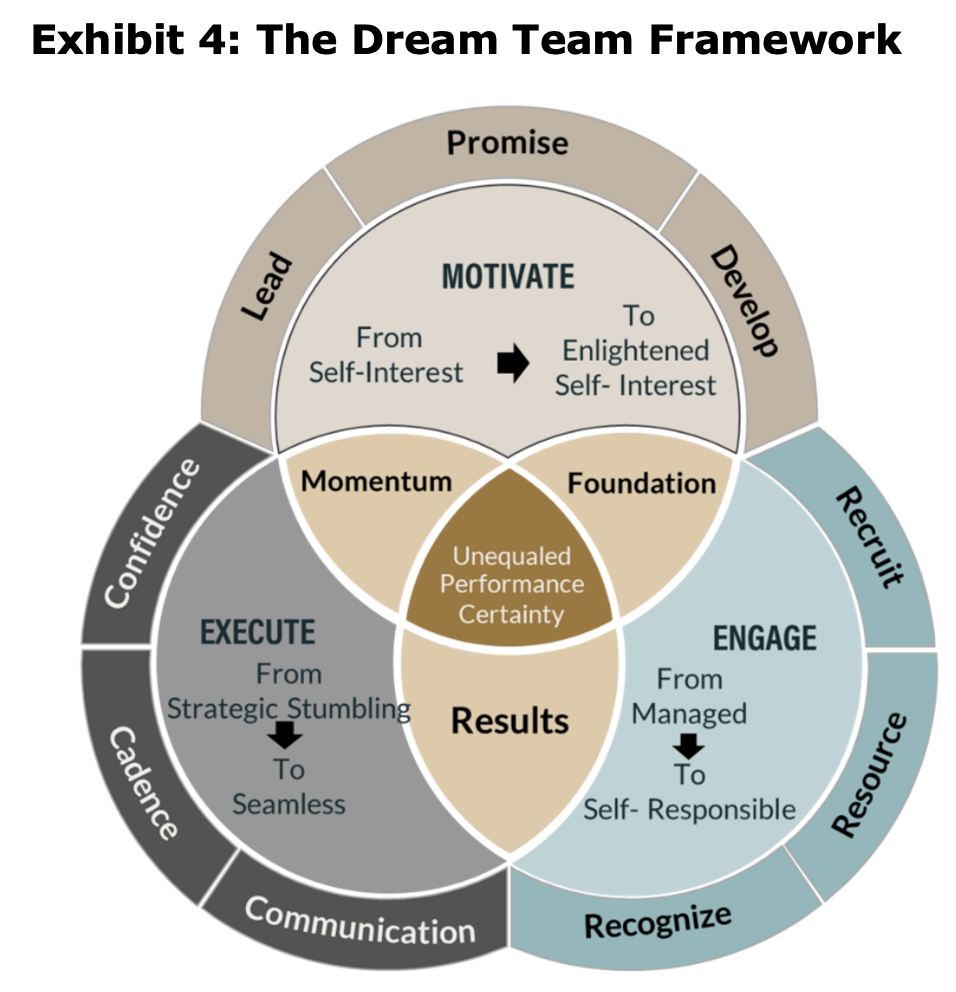

Building such a dream team involves focusing on three key levers—motivate, engage and execute—each supported by nine accelerators. The framework for such a team is summarized in Exhibit 4.

1. Motivate: Inspire And Empower Your Team. Inspire your team members to look beyond their individual goals and embrace a collective mission. Encourage a culture of enlightened self-interest, where each team member recognizes that their success is intertwined with the success of their colleagues. Lead by example, demonstrating the value of collaboration and personal growth.

• Lead: Promote a culture of co-elevation and shared success. Only 8.1% of advisors feel their teams are correctly aligned with shared objectives, indicating a need for improved team dynamics. Foster a culture where team members lift up not just themselves but also every teammate, enabling the team to achieve truly exceptional results.

• Promise: Be true advocates for clients, and deliver exceptional value. Dream teams go beyond simply delivering the minimum or delighting clients; they defend their clients and are true advocates, helping clients build amazing lives of significance.

• Develop: Facilitate continuous learning and growth for all team members. Ensure team members are systematically developed through mentoring, coaching and performance management.

2. Engage: Strategically Align And Empower. Place the right people in the right roles and empower them to excel with minimal oversight. Cultivate a team of self-responsible individuals who understand how to leverage their unique skills to achieve the practice’s objectives.

• Recruit: Strategically recruit the right talent. Evaluate candidates’ alignment with the practice’s vision, culture and values as well as their professional qualifications. Dream teams know what types of team members they need and how to best harness their talents.

• Resource: Establish a strong foundation of shared values and objectives. Promote a team culture that values collaboration, open communication and a commitment to client success. Dream teams are clear on their shared values and what the team is trying to create and achieve. Support your team in establishing this clarity of purpose and building the foundation to support the team’s vision.

• Recognize: Acknowledge and celebrate individual and team contributions. Implement systems that recognize and reward team contributions, fostering more substantial commitment and performance from everyone in the business—while remembering that every member of a dream team also wants to be recognized for their significance as individuals.

3. Execute: Ensure Seamless Implementation And Performance. Clear communication and disciplined workflows are crucial for seamless execution. Build quiet confidence within your team, ensuring that every member is clear about their roles and confident in their ability to contribute effectively. Eliminate ambiguity about the team’s direction and methods, setting the stage for outstanding performance.

• Confidence: Equip teams with the knowledge and strategies to serve clients confidently. To serve wealthy clients exceptionally well, dream teams need genuine confidence in their knowledge about the affluent market and what affluent clients genuinely want. Ensure your team combines information from empirical research with insights from direct experience to design your client experience, resulting in quiet confidence rooted in facts and successful experience.

• Cadence: Implement performance structures to maintain team effectiveness. Dream teams use systems and processes to help them remain on track and continue to reach their highest potential. Develop performance metrics and structures to maintain and enhance team effectiveness over time.

• Communication: Foster transparent, effective communication in and across your team. Dream teams amplify the influence of each team member. Develop clear communication strategies that balance personalized attention and the benefits of a team-based approach.

The Path Forward

As financial advisors transition from their initial roles into the broader responsibilities of an accidental CEO, they’re clearly facing significant issues. While they recognize their teams’ critical role in driving their practices’ outcomes, many also find their teams need significant help with cohesion, collaboration and performance.

This reality underscores the urgent need for a strategic transformation in team dynamics and leadership.

For you, the journey from financial advisor to visionary leader is both a challenge and an opportunity. By taking the initiative to embrace the role of a leader and implementing the framework of motivating, engaging and executing, advisors can build dream teams that deliver exceptional results. This framework fosters a culture of co-elevation, strategic alignment of team roles, and seamless execution—all under the advisor’s control and influence.

Ultimately, the best way forward is to create teams that support and elevate each other while working toward common goals. This approach not only benefits clients but also drives the overall success of the practice. Advisors who adopt this strategy can overcome team dysfunction and complacency issues.

By building dream teams, advisors not only enhance productivity but also attract top performers to their teams. Furthermore, they position themselves to be highly successful in merger and acquisition opportunities. This strategic advantage enables advisors to expand their practice, integrate seamlessly with other firms and achieve significant growth.

Seize The Opportunity

Great endeavors are rarely accomplished by one person alone. Advisors seeking to excel must recognize their pivotal role in building and leading a high-performing team. Doing so can maximize their potential for success and significantly contribute to the practice’s overall success.

The time to act is now. Seize the opportunity to build and lead your dream team and watch your practice soar to new heights.

John J. Bowen Jr. is the CEO and founder of CEG Worldwide and CEG Insights.

For more information, read the entire report, "The Dream Team Effect: Mastering Team Dynamics to Achieve Wealth Management Excellence," at www.cegworldwide.com/teams.