As investors favor staples, it’s become popular to dump stocks exposed to lower-income consumers because they spend a higher proportion of their incomes on food and fuel. Consequently, the thesis goes, they will be disproportionately affected by rising prices.

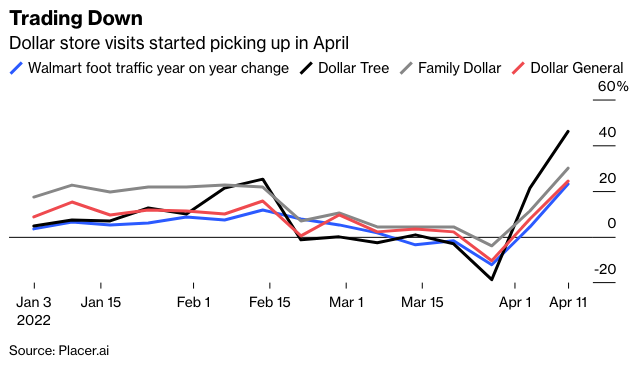

But this misses a key point. While some loyal shoppers will have to pull in the purse strings and buy less at discount chains, these retailers could benefit from higher-income consumers trading down. Therefore, any loss of sales from traditional customers should be offset by an influx of new shoppers. Walmart said in February that all consumers — even wealthier families — become more price sensitive during periods of inflation.

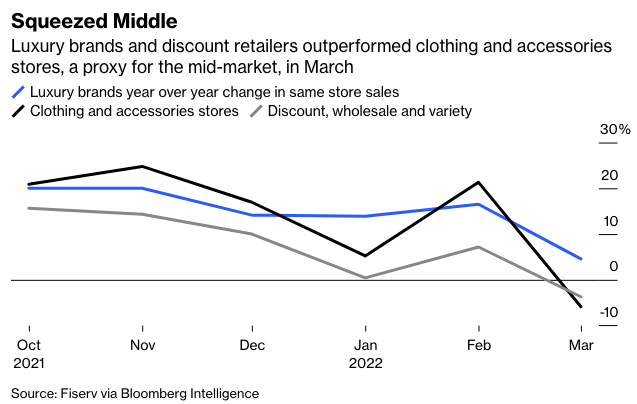

The biggest danger to investors therefore lies not in the bargain basement but the squeezed middle. Some signs of this are already playing out.

Clearly, some of Gap Inc.’s problems at Old Navy are of its own making — not having enough fashionable dresses and tops as shoppers rapidly pivot from cozy to chic, for example. Supply chain bottlenecks haven’t helped either.

But Old Navy is exactly the type of brand that is vulnerable to rivals such as Walmart and Associated British Foods Plc’s Primark, which is opening more U.S. stores and trading well in the region. Although Target’s prices are similar to Old Navy’s, its fashion is edgier, something that consumers are prioritizing as they head out to restaurants and prepare for vacations. TJX Companies Inc., owner of T.J. Maxx and Marshalls, may be another beneficiary from stretched budgets.

Trading down could also favor the likes of Chipotle Mexican Grill Inc., as Americans swap pricier takeouts or a meal at a fast casual restaurant for value fare. Although Chipotle has raised prices, it has seen little resistance from customers, perhaps because the increases were from a low base.

So while investors have got it right by favoring staples, the market is likely to get trickier from here; investors may need to get choosy. Companies that discount essentials may be one of the final refuges if the outlook worsens.

Jonathan Levin has worked as a Bloomberg journalist in Latin America and the U.S., covering finance, markets and M&A. Most recently, he has served as the company's Miami bureau chief. He is a CFA charterholder.

Andrea Felsted is a Bloomberg Opinion columnist covering the consumer and retail industries. She previously worked at the Financial Times.

Defensive Stocks Take Their Turn As Highfliers

April 28, 2022

« Previous Article

| Next Article »

Login in order to post a comment