There’s still a lot of noise in the latest U.S. inflation report, but the things that matter are moving in the right direction.

The core consumer price index—which excludes volatile food and energy prices—rose just 0.2% in May from the previous month, the softest month-on-month inflation since August 2021 and less than the 0.3% projected by the median economist in a Bloomberg survey (unrounded, the May number came to 0.1631%). The so-called supercore services index—which excludes the lagged shelter category—saw prices fall slightly from the previous month, the first time that’s occurred in nearly three years.

It was just one month in a notoriously volatile data set, of course, but it adds to evidence from April that the hot first quarter was an aberration in a longer disinflation process. Core CPI rose 3.4% from a year earlier, a major improvement for an index that peaked at 6.6% in 2022—but still a long ways from the Federal Reserve’s 2% target (which is technically based on another measure of inflation, PCE.)

Under the hood, there were plenty of encouraging signals for Fed policymakers to chew on as they head into their interest rate decision at 2 p.m. in Washington. They’re all but guaranteed to keep the policy rate at a two-decade high, but should provide some tentative direction on what to expect later this year.

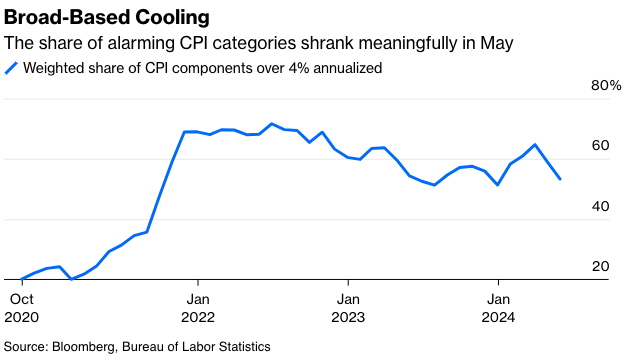

First, the breadth of the ongoing inflation is getting much narrower. Across the CPI, the weighted share of components inflating by more than 4% annualized fell to 53%, down from 59% a month earlier. Within the core index, the only two broad categories that experienced month-on-month inflation that’s at least a standard deviation above their 2017-2019 “normal” were medical care commodities and the famously problematic shelter gauge (more on that later).

Amid the fog of lags and imputations, it was always going to be important to monitor vanilla consumer services categories for signs of enduring inflation, and the news there was mostly encouraging. The personal care services category (which includes haircuts) cooled following a hot April, as did laundry and dry cleaning. Recreation services showed month-on-month deflation for the first time since August 2023. And food away from home (read: restaurants) rose 0.4% month-on-month, a slight pickup from the month earlier but nothing to be alarmed about. Restaurants notwithstanding, many of these are smaller categories by weighting, but they could be canaries in the inflationary coal mine, and they seem to be signaling progress in the right direction.

Then there were the lagging categories: motor vehicle insurance and shelter. The former swung from a major source of upward inflationary pressure in the past year to a slight drag, providing some relief on the headline number—albeit meaningless relief because it tells us little about where inflation is heading. Companies have lifted insurance premiums to account for past inflation in the underlying cost of autos, parts and repairs, yet that occurs with a lag due to heavily regulated pricing. It’s good to see the data turn in our favor for one month, but I’m not convinced that the volatility there is over. Allstate Corp., for instance, said on an investor conference call last month that it had achieved “rate adequacy” in many states but that it was still pursuing increases in others, including a 13.9% increase coming to New Jersey in the second half of the year.

As for shelter, the heavily weighted rent and owners’ equivalent rent categories saw prices rise 0.4% from the previous month, the same as April . But Inflation Insights LLC President Omair Sharif projects that it may start stepping down in June (with the data released the following month). He’s keeping an eye on the Bureau of Labor Statistics’ All Tenant Regressed Rent Index, which will get updated in July and tends to provide strong signal about where CPI rents are going.

Federal Reserve Bank of Chicago President Austan Goolsbee famously likes to say that, from the vantage point of economists and policymakers, one month of inflation data is “no months,” and that’s why Fed policymakers are still likely to keep rates at a two-decade high until at least September. Fed Chair Jerome Powell should strike a cautiously optimistic tone at the policy decision and press conference this afternoon. In the new edition of policymakers’ Summary of Economic projections, I’d expect them to implicitly bless the market’s prevailing expectations of only 1-2 rates cuts this year, compared with three in the last update. All told, the news from CPI was about as good as you could have hoped for—and there may be some additional help from shelter disinflation around the corner.

Jonathan Levin is a columnist focused on U.S. markets and economics. Previously, he worked as a Bloomberg journalist in the U.S., Brazil and Mexico. He is a CFA charterholder.

This article was provided by Bloomberg News.