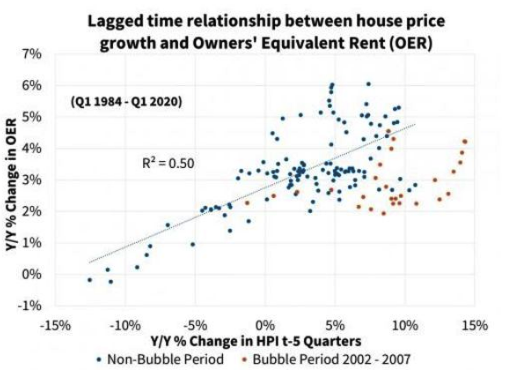

When the property market is in a true bubble, and prices are higher than can be justified by the rental yield they could raise, the effect is less direct. That appears not to be the case at present. Excluding the “bubble” period from 2002 to 2007, the relationship is tight:

Eric Brescia, economist at Fannie Mae, makes these concerning conclusions:

• Lagged effects from the past year's house price appreciation and more recent rent recovery could begin to flow into inflation measures as soon as the May readings. House price gains to date suggest an eventual acceleration in shelter inflation from the current rate of 2.0 percent annualized to about 4.5 percent. If house price growth continues at the current pace, shelter inflation would likely move even higher.

• Timing lags suggest increasing shelter inflation will last through at least 2022, meaning "transitory" increases to the rate of overall inflation may be more prolonged than many are expecting. Due to the heavy weight given to shelter, housing could contribute more than 2 percentage points to core CPI inflation by the end of 2022 and about 1 percentage point to the core PCE. Both would be the strongest contributions since 1990.

It would be stretching definitions to call this another housing bubble. But the natural human tendency to perceive housing as a more attractive investment than it is leads to the real risk of higher inflation than many now appear to expect. While this dose of housing inflation need not inflict the horrors of past bubbles, it could create problems if it carries on much longer.

Survival Tips

Meanwhile, continuing last week’s theme of the lessons that goalkeeping errors can have for investors, I should draw the first goal of the Spain-Croatia game from Monday to your attention. Here it is. The moral: Don’t do whatever the investment equivalent is of standing with nobody anywhere near you and nonchalantly directing the ball into your own net.

John Authers is a senior editor for markets. Before Bloomberg, he spent 29 years with the Financial Times, where he was head of the Lex Column and chief markets commentator. He is the author of The Fearful Rise of Markets and other books.

• Due to how shelter costs are measured, the housing components of the indices decelerated considerably over the past year, despite strong home price appreciation. This has kept topline inflation from being even higher.

Maybe don’t try writing rather a long and complicated financial newsletter while trying to watch England knock Germany out of an international soccer tournament for the first time since a couple of months before you were born, as I did today. But it was fun. Many congratulations to Ukraine for the remarkable way they beat Sweden at the death in Tuesday’s other game. With few historical disputes between England and Ukraine, maybe the English can manage to be a little less chauvinistic before the quarter-final.