Hedge funds once seemed crucial to helping the College of Wooster boost the value of its endowment. Not anymore.

“We were the king of hedge funds,” said John Sell, an economics professor who also serves as the investment director at the $263 million endowment in the Ohio town of the same name. Now school officials have “increasing skepticism of active management. Hedge funds are the classic example of super-active management,” he said.

Investment losses from hedge funds and other “marketable alternative strategies” were biggest in the year ended June 30 at college funds with $101 million to $500 million in assets, according to a survey of about 800 institutions from the National Association of College and Business Officers and money manager Commonfund. Their 4.3 percent decline compares with a drop of 3.6 percent at the largest endowments.

Wider Trend

Wooster’s decision to slash hedge fund holdings to 25 percent of its portfolio from almost half in the past five years is part of a wider trend of institutions, including public pension funds, questioning the value of hedge fund investments. Sell said his endowment’s “main discussion” centers on the use of more passive management to reduce costs and improve returns.

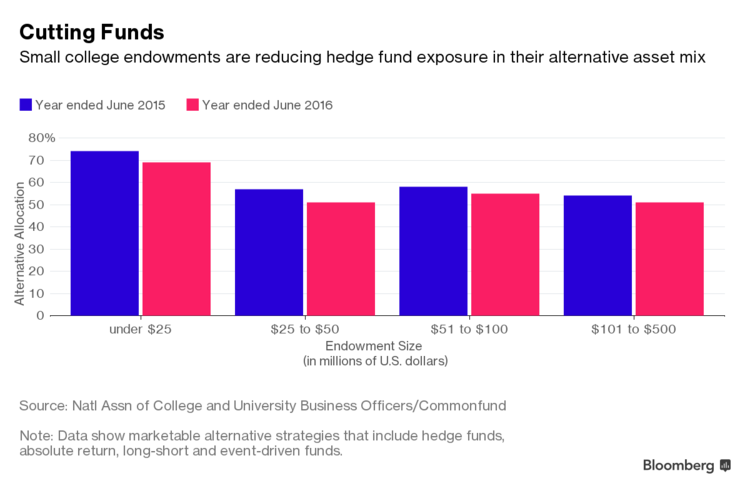

College endowments with assets of $25 million to $50 million -- minnows compared with Harvard University’s $35.7 billion endowment -- have been among the most aggressive in slashing their allocations to hedge funds as they realized that the high fees the pools charged weren’t always justified by performance.

This group of funds reduced allocations to marketable alternative strategies by 6 percentage points from the previous year to 51 percent of their alternative strategy, according to Nacubo. The share at endowments with more than $1 billion in assets declined by 1 percentage point to 37 percent of the larger strategy.

Inferior Deals

Nacubo’s broader category of alternative strategies, which include hedge funds, private equity and venture capital, made up 10 percent of the smallest endowments’ asset allocation and 58 percent of the biggest school funds. Funds in the $51 million to $100 million range had about a quarter in alternatives.

Smaller colleges often get inferior fee deals because they’re not big enough for direct investments in hedge funds and instead turn to funds of funds, adding another layer of expenses, said Elizabeth Parisian, the author of a study last year by Hedge Clippers, which surveyed hedge funds in endowments.