Talk about leaving money “on the table.”

The current darling of the “Magnificent 7,” Nvidia, the microchip manufacturer that is helping to drive the AI revolution, saw its market capitalization shoot up to $2 trillion just 180 trading days after hitting the $1 trillion mark (according to Dow Jones market data).

However, according to Nvidia’s own public filings, none of its executives own stock options in the company. Considering the explosion in Nvidia’s valuation, that represents an enormous lost opportunity.

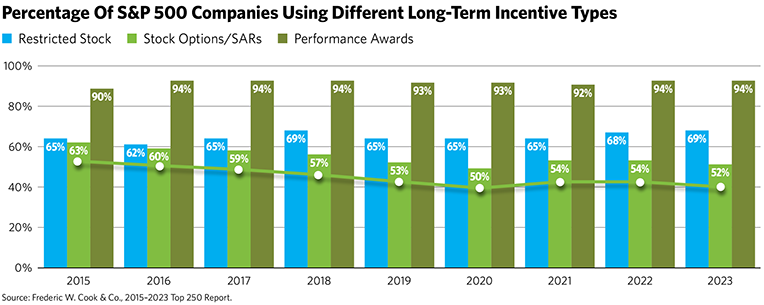

If it brings the leaders of Nvidia any consolation, they are not alone. The trend in recent years among executives at both public and private companies has been to not ask for stock options or stock appreciation rights (“SARs”) as part of their overall compensation packages. Like many other companies, Nvidia has eschewed the perceived complexity of stock options in favor of time-based and performance-based equity grants. These “simpler” forms of equity compensation still allow for handsome returns and meaningful participation in a company’s success, but few alternatives rival the exponential wealth creation power of exercising an option at a low price before a stock shoots into the stratosphere.

Again, that represents significant money left on the table.

To reverse this trend and help executives ask for and exercise the stock options they deserve, advisors should explore these key considerations with their executive clients:

Negotiating Stock Options

• Executives should buck the trend and explicitly ask for stock options as part of their overall compensation. It shouldn’t be considered “taboo” or overly self-serving. Stock options help ensure that a firm, its investors and its executives have their interests aligned and that all benefit when those options go up in value, which makes them a “win-win-win.” Such options might not always be available—when it comes to publicly traded companies, only the highest paid executives can exert enough influence to request special grants or the reopening of a stock option plan that’s already been eliminated. But entrepreneurs and executives at young companies (i.e., startups) or private corporations with aspirations of significant growth should be able to use stock option compensation. Such fledging non-publics are also more likely to grant incentive stock options, which receive more favorable tax treatment than the non-qualified stock options typically issued by large public corporations.

• Know the standard practices in your client’s industry. When it comes to stock options, not all industries and sectors are created equal. In consultation with their advisors, executives should explore what the standards are in their industry. Are stock options common practice? What quantity is typical? Again, there can be a wide variance by sector when it comes to these options—executives in real estate are generally not likely to receive stock options as part of their compensation packages, whereas such compensation is quite common in tech. Once you know what is commonplace in your client’s industry, they should align their ask to that percentage. The point is that your clients shouldn’t negotiate in a vacuum. Executives at privately held companies should push for incentive stock options, which are relatively tax-friendly.

• Engage with legal counsel. Your executive clients finalizing their compensation package should connect with their legal counsel to carefully review their option grants and ensure they are getting the best possible package. They should understand, for instance, under what conditions stock options are forfeited and what happens to the options if their companies are bought out.

• Have a fallback plan. If a firm balks at offering your client stock options, it’s important they have a fallback plan to ensure they are compensated commensurately. Any refusal by companies to offer stock options could be used by an executive as leverage to get more cash compensation—or better retirement benefits or a pension. Some corporate structures may even allow for tax-advantaged “profits interests” in lieu of traditional cash or equity compensation. Advisors should work with clients to explore all the ways they can receive the compensation they deserve.

Exercising Stock Options

• When it comes to exercising stock options, executives should consult with their advisory team. When your client has robust stock options hopefully in place, the first step in exercising them is to connect with a highly qualified tax advisor and financial planner. The process can seem overwhelming, but a talented team of advisors should be able to simplify the process and model out how and when to exercise a client’s stock options. They should do the math to clearly present a cost-benefit analysis of various scenarios, which should tell a client how much and when to exercise according to different variables. The reality is that most executives wait until the last possible date to exercise; they end up leaving money behind this way because while they are not holding the stock they lose money by missing dividend payments, potentially sleepwalk into a higher tax rate or shorten their holding period for capital gains purposes if the stock appreciates.

• Consider the client’s overall financial picture. Once a client has consulted with their advisory team and decided on the approach that makes the most sense for them, they should integrate that strategy with their overall financial plan to ensure it is congruent with their goals. For example, will their gifting plans (to family or charity) be affected by the valuation of their stock options? How much will their retirement and future lifestyle depend on the appreciation of their equity? What happens if they move to a new state (or even a new country)? These are the types of issues they should evaluate with their strategic advisors.

Allen Injijian is managing director and head of wealth strategy and planning for Geller Advisors.