There is a lot of talk about “ideal clients” in the wealth management industry. Who are ideal clients depends on whom you speak with.

There are various ways to define ideal clients. In terms of assets under management, liquid assets work well, but this is a truism. Another way to segment is psychographics. This is how the ideal clients think about themselves and money. For example, some investors identify money with family security, while other investors mentally connect wealth with power or fame. A common approach to segmentation and defining ideal clients is based on the source of wealth. How did the segment of clients come to have money to invest?

Segmenting By Source Of Investable Assets

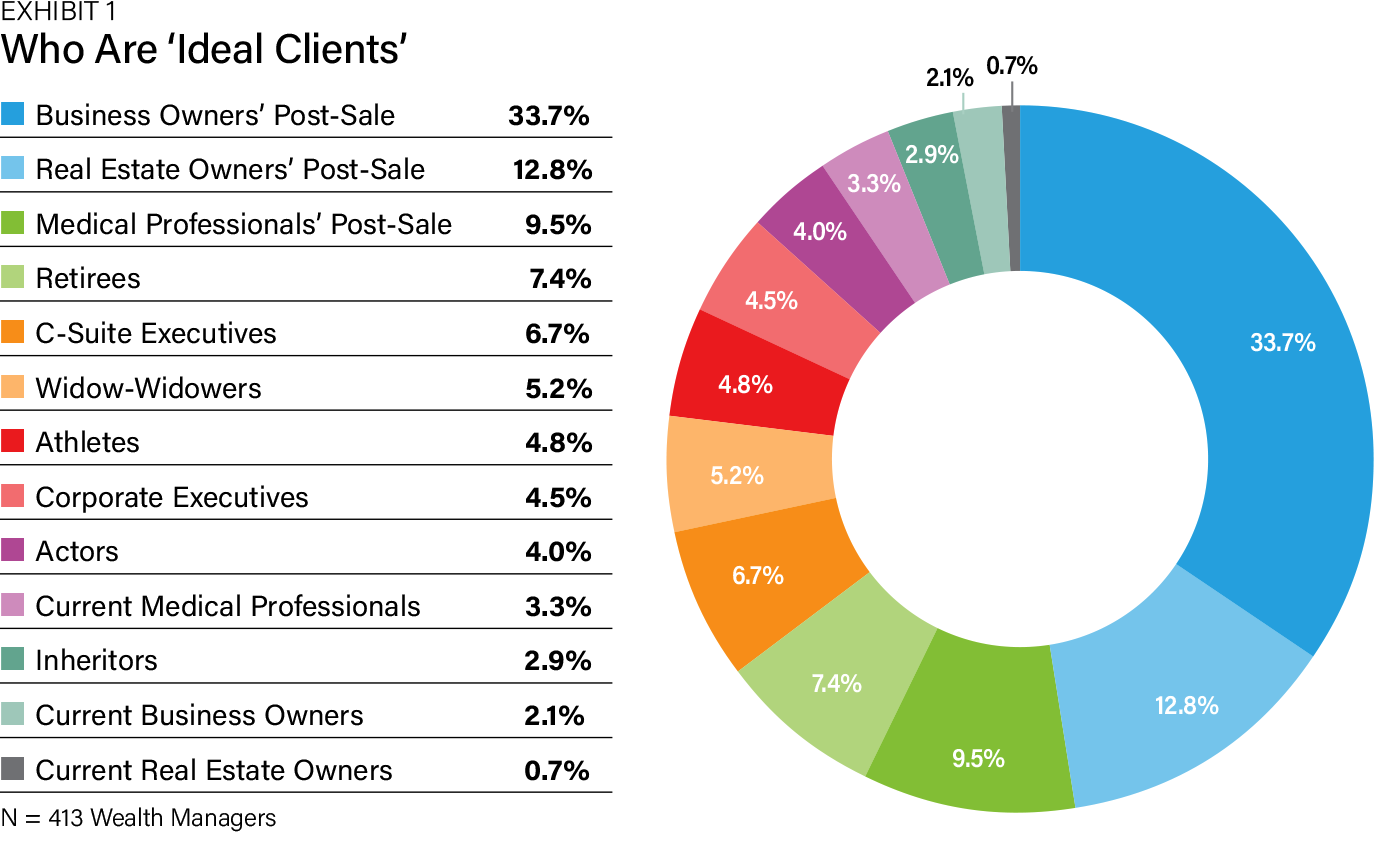

A survey of 421 wealth managers was conducted to see who they believed was the best source of investable assets. They were asked to identify their ideal clients (Exhibit 1). These need not be the clients they are presently working with. They are commonly clients the wealth managers want to and strive to have more of.

The unquestionably preferred ideal clients for a third of the wealth managers are business owners who sold their companies. The sale of the company creates a pool of assets that wealth managers can invest. In objectively evaluating the greatest source of potential assets to manage on a per-client basis, these would be the preferred clients. Contributing to the attractiveness of business owners post-sale is that, because of demographics, many business owners will sell over the next few years, and a great deal of money will be available for professional management.

The business owners who sold their companies were followed by real estate owners who sold their real estate holdings. Then came the medical professionals who sold their practices. For more than half the wealth managers, the liquefaction of an illiquid corporate asset—an operating business, a real estate holding, or a medical practice—will likely produce the largest pools of money to invest.

Less than 8% of the surveyed wealth managers identified another type of ideal client. Remember, there is no best ideal client, for it depends on the wealth management practice and the nature of the wealth manager.

For example, in working with a wealth manager, we helped him access significantly wealthier clients than he was currently serving. According to him, these were his ideal clients, and they generated a multiple of the revenues he was earning from his current clients. Working with them required a high-involvement approach than the wealth manager was comfortable with. These wealthier clients were not the ideal clients for this wealth manager.

Connecting With ‘Ideal Clients’

Connecting With ‘Ideal Clients’

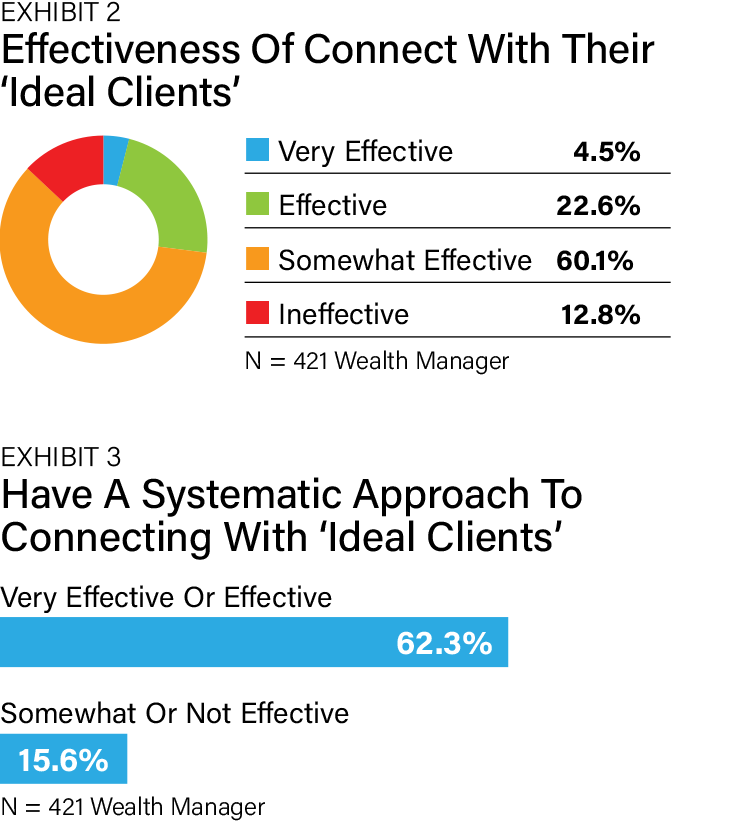

While wealth managers can identify their ideal clients, they are not particularly adept at connecting with them (Exhibit 2). Most wealth managers say they are somewhat effective, and a sixth say they are ineffective. More than a fifth report they are effective, but only 4.5% say they are very effective.

Analyzing the survey responses, we found a significant difference between wealthy managers who were more effectively connected with their ideal clients and those who were not. The big difference was how systematic the wealth managers were. The more systematic the wealth managers were in connecting with their ideal clients, the more effective they were (Exhibit 3). Being methodical regarding business development, provided the process is sound, makes an enormous difference in connecting with ideal clients.

Connecting With Business Owners Who Sold Their Companies

Often, the biggest issue for wealth managers who define their ideal clients is connecting with them. There are several proven ways wealth managers can do so. There is usually a lot of competition for the assets of these former business owners after the sale. Knowledge of the sale gets around, and numerous professionals come knocking at their doors. Optimally, when the sale becomes public, and the investment professionals flock to the former business owners, they have already decided who to entrust their assets to.

The most effective approach is to provide value to the business owners before the sale. Helping them structure their personal finances and navigate the sale builds trust and allows wealth managers to demonstrate their capabilities.

The most powerful way to meet business owners considering selling is through other professionals, particularly accountants. More than any type of professional, business owners are likely to speak to their accountants when they start to think about exiting or when they get an offer. This does not mean other professionals are not in the loop, but accountants are the most often relied upon. There are various ways to develop a systematic approach wealth managers can implement to build strategic partnerships with accountants, so they are actively looking for business owners thinking about selling that they can introduce to the wealth managers.

Another potent systematic approach is educating business owners on how to maximize their wealth when they sell their companies. For example, presenting at mastermind groups such as YPO, EO and Vistage enables wealth managers to reach the right audiences. Still, the nature of the presentation makes a tremendous difference. Straight-up lectures rarely lead to opportunities, no matter how well delivered or chock full of vital information. Instead, interactivity can be very effective, where the insights empower the business owners.

Conclusion

Due to demographics, business owners post-sale will likely become ideal clients for a more significant percentage of all wealth managers. This is more the case for the cohort of wealth managers wanting to work with wealthier clients.

Building solid relationships with other professionals, notably accountants, is an excellent way for wealth managers to capitalize on this opportunity and create an expansive ideal clientele of post-sale business owners. Another non-exclusive possibility is for wealth managers to develop insightful presentations to give before groups of business owners at mastermind groups and similar conclaves.

Jerry D. Prince is the director of Integrated Academy, part of Integrated Partners, a leading financial advisor firm. Russ Alan Prince is a strategist for family offices and the ultra-wealthy. He has co-authored 70 books in the field, including Making Smart Decisions: How Ultra-Wealthy Families Get Superior Wealth Planning Results.