Paul Lofties, CEG Worldwide

Co-host, The Preeminent Financial Advisor podcast

Cathy McBreen, CEG Insights

Co-host, The Preeminent Financial Advisor podcast

Key Takeaways:

• Fulfilling personal relationships and good health are key nonfinancial concerns of the affluent that you need to recognize.

• Going beyond the numbers is a good way to attract additional assets.

• Build a virtual family office that delivers tremendous value.

As advisors, you’re extremely comfortable delving into your clients’ financial goals so you can craft plans, portfolios and other solutions aimed at getting them to those desired outcomes.

But what if you went beyond the financial issues by also helping your clients build a life of deep personal significance and meaning? It turns out, you stand to gain a lot by providing leadership and guidance in key non-financial areas of your clients’ lives.

Face The Facts

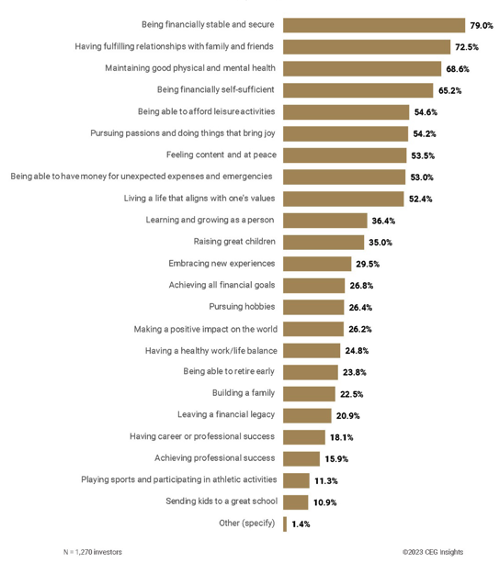

When CEG Insights asked approximately 1,500 affluent investors to tell us what “living one’s best life” meant to them, the top response—not surprisingly—was “being financially secure.” But, as seen in Exhibit 1, the second most-popular answer was “having fulfilling relationships” and the third-place response was “maintaining good physical and mental health.”

Exhibit 1: Defining Living One’s Best Life (By Total)

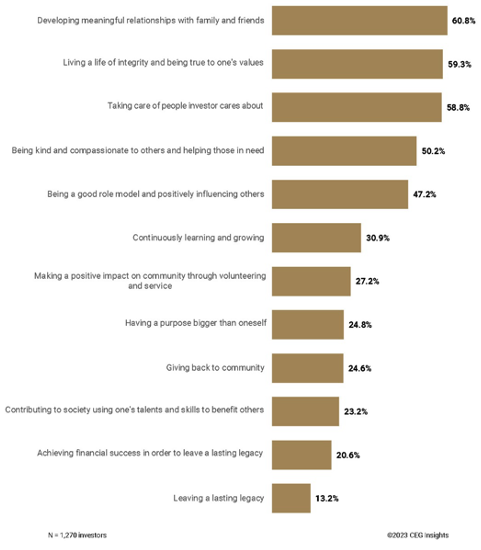

Then, when we asked them to define what it meant to them to live a “life of significance,” the #1 answer was “developing meaningful relationships”—essentially mirroring the second-place answer from above—followed by “living a life of integrity and being true to one’s values” and “taking care of people” the survey respondents care about (see Exhibit 2).

Exhibit 2: Defining Living A Life of Significance (By Total)

Clearly, your affluent clients and prospects care about a whole lot more than just their net worth—and they strongly believe that a life of meaning and significance entails far more than amassing huge sums of money.

• They value their families and friends.

• They seek to stay healthy and active.

• They want to make decisions that are in sync with their values.

• They hope to take good care of the people they love.

Insights Into Action

The message to financial advisors is crystal clear: Go beyond the numbers and the investments with your clients. Discover what they want from life that would bring them meaning and fulfillment—and then help them pursue those deep nonfinancial goals.

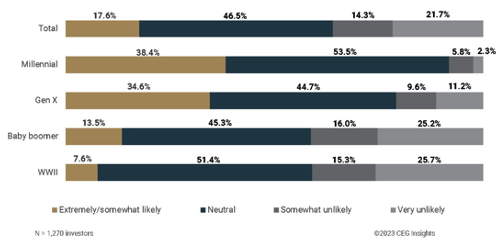

Consider what doing so could mean to your practice. As seen in Exhibit 3, nearly one-fifth of affluent investors (17.6%) say they’d move more assets to an advisor who inquired about their goals and aspirations outside of finances. For millennials and Gen X-ers, those percentages jump to 38.4% and 34.6%, respectively.

Exhibit 3: Likelihood Of Moving More Assets To Advisor Who Asked About Nonfinancial Definitions Of Success (By Age)

The upshot: When combining those clients who are extremely or somewhat likely to move assets with those who have neutral feelings about the situation, it becomes obvious that there’s little downside to asking clients—particularly millennials and Gen X-ers—about their nonfinancial success attitudes.

That said, be aware how this compares with older investors. The percentage of boomer and WWII-era clients who feel neutral or positive about an advisor inquiring about their personal lives and would potentially move assets is significantly lower.

To go beyond the numbers, consider these action steps:

1. Conduct deep discovery. Ask clients and prospects about their values, their important relationships, their health concerns and the goals they have for the people they care about most. And don’t just ask once. Make these conversations part of your ongoing dialogue with clients, since their nonfinancial concerns may evolve and change over time.

2. Build a team of experts. Look to create a network that includes professionals who can help your clients with their biggest nonfinancial concerns. That might include a family mediator to help with family-related challenges, a concierge physician group that enables clients to access high-quality healthcare quickly, a wellness coach or other experts based on what your clients tell you they value.

Ultimately, you want a virtual family office structure, with you at the center of it—coordinating various professional resources for your clients that work in concert to deliver tremendous value to their lives.

Access the full podcast episode here.

Catherine McBreen and Paul Lofties are leading innovators in wealth management research.