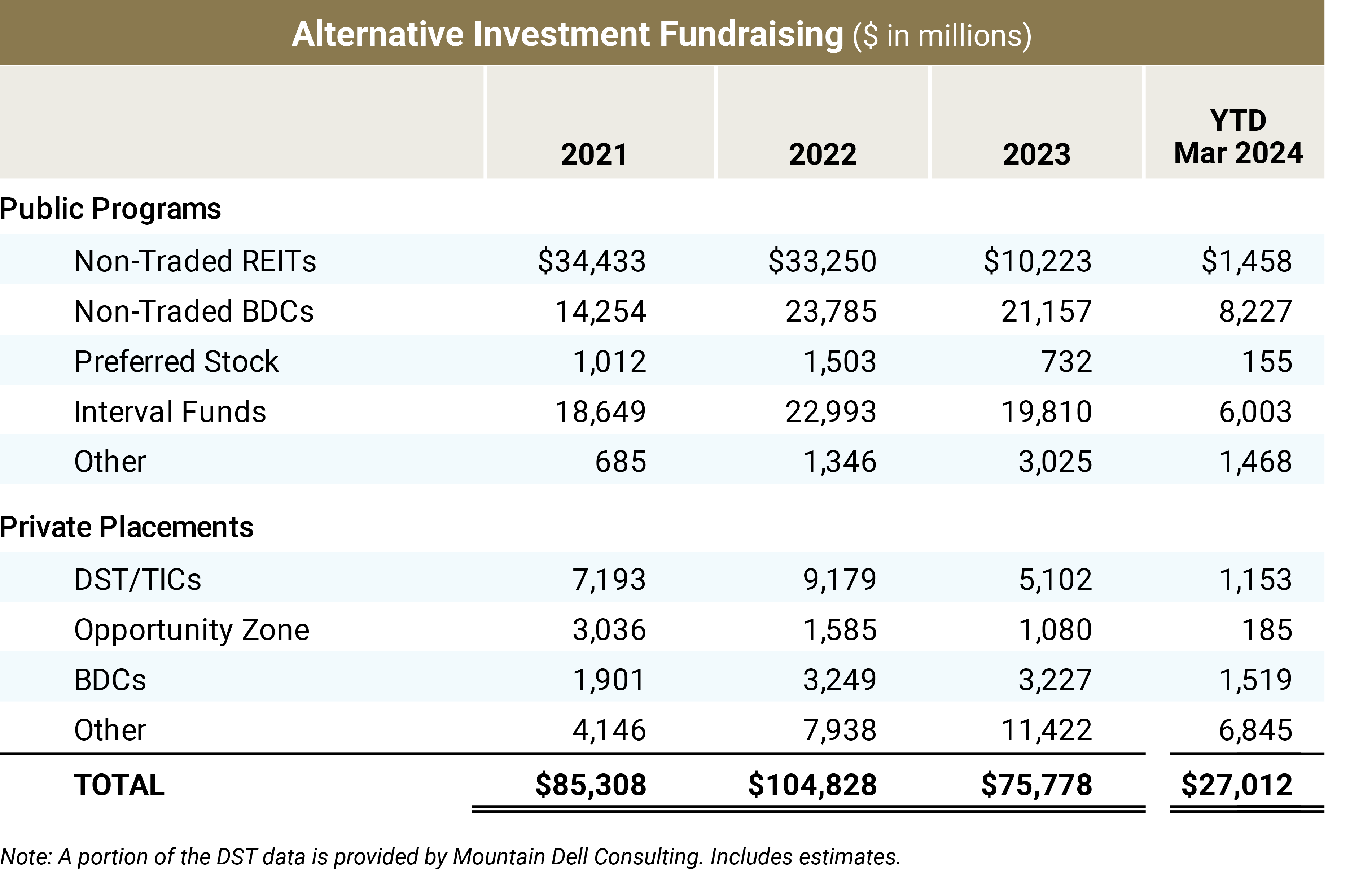

The popularity of Alternative Investments has mushroomed over the past ten years as individual and institutional investors have sought alternatives to traditional stock and fixed income portfolios. Alternative Investments include publicly registered but non-traded Real Estate Investment Trusts, Business Development Companies, Interval Funds and Operating Companies along with private placements securities for Delaware Statutory Trusts, Opportunity Zone Programs, BDCs, and programs focused on Infrastructure, Private Equity, and Private Credit. Individual investors can access these investment vehicles sponsored now by some of the biggest names in the investment world through both large and small broker dealers and registered investment advisors. Robert A. Stanger & Company, Inc. has tracked fundraising for Alternative Investments in the retail channels for more than forty years in one of our flag-ship publications, The Stanger Market Pulse, where we captured almost $300 billion of capital formation over the past three years and through the first quarter of 2024 as noted in the table below:

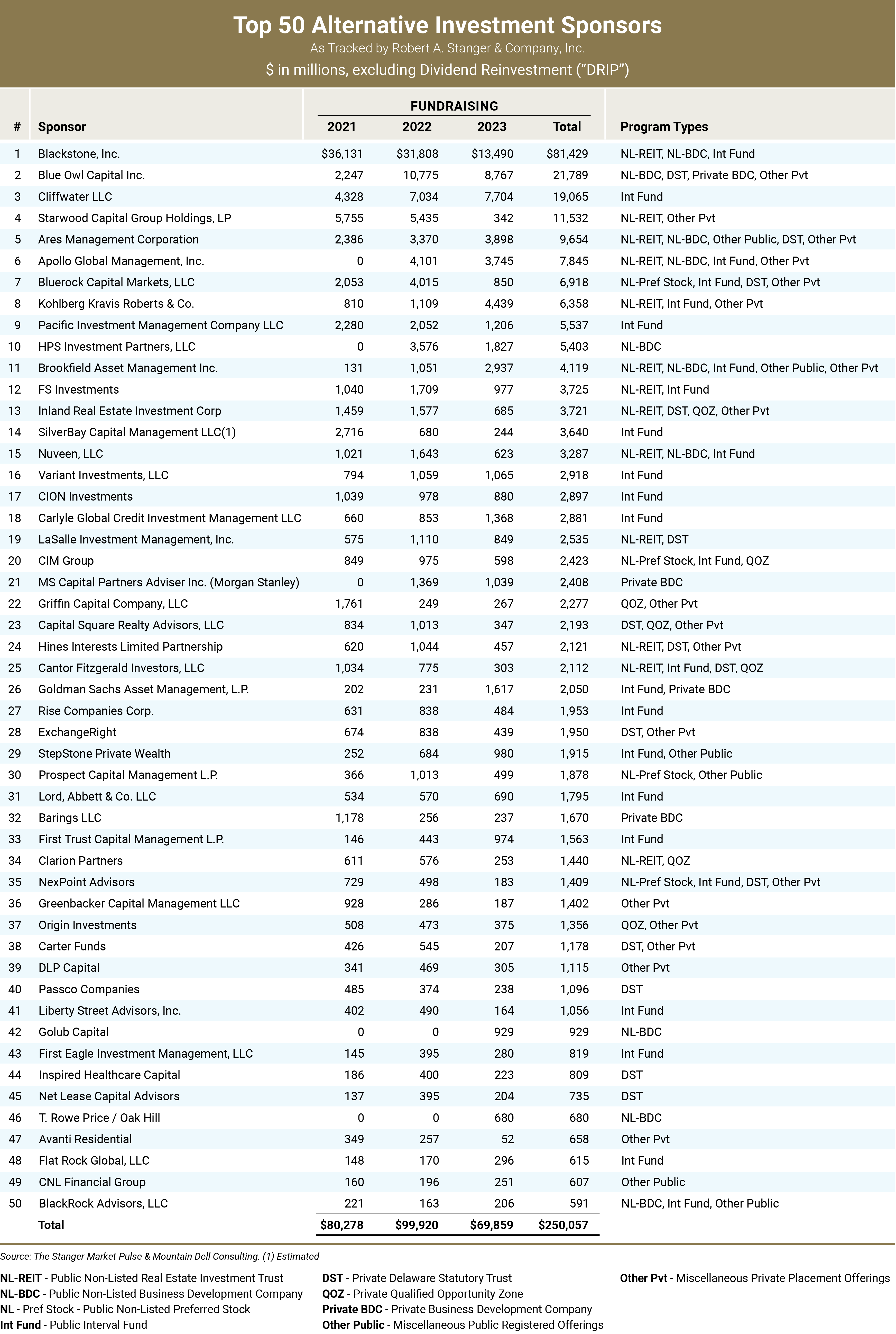

Fundamentally, this explosion in capital formation has come from three things: liquidity, performance, and sponsorship. First, many Alternative Investment products have been structured with a liquidity feature that allows investors to redeem their interests on a monthly or quarterly basis for up to 20% of shares outstanding. This liquidity feature has proved to be an important factor to investors and has provided more than $30 billion of liquidity over the past three years. Stanger tracks the liquidity features and performance of most alternative investments in its various publications: The Stanger Market Pulse, The Stanger Report, The Stanger Chairman’s Report and The Stanger Interval Fund Report. Second, performance has been strong and is measured monthly by valuations at net asset value. This can, at times, provide superior results to the volatility of stock market performance. And third, sponsorship has been upgraded to some of the most well-known names in the institutional world, led by Blackstone and closely followed by Blue Owl Capital, Cliffwater, Starwood, Ares, Apollo, Bluerock, KKR, PIMCO, HPS and Brookfield. Stanger’s Top 50 Alternative Investment Sponsors ranked by 3-year total fundraising, is shown in the table below:

Disclaimer: Fundraising included in the Top 50 Alternative Investment Sponsors includes data from sponsors or advisors who have cooperated in providing sales or have reported sales in filings available to the public. Reported fundraising may not include all investment products offered by the sponsor or advisor and the totals shown may not be indicative of the entire market. DST fundraising in non-listed REITs is recognized when OP units are issued in exchange for DST interests.