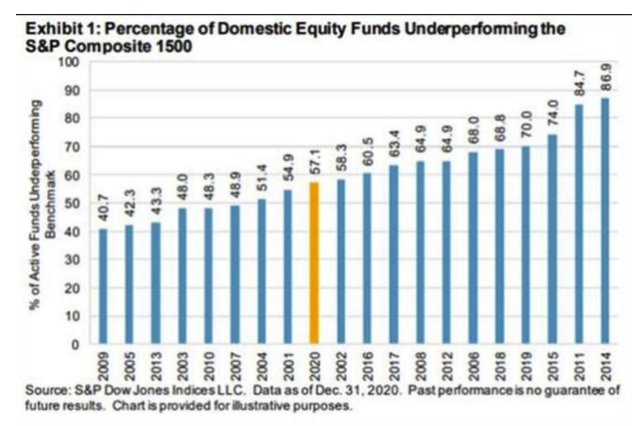

These basic indicators are borne out in the overall statistics for active fund performance last year. Last year, according to the S&P Dow Jones Indices LLC “SPIVA” methodology, 57.1% of U.S. equity funds lagged behind the broad S&P Composite 1500. The last year a majority of funds managed to lead the index was 2013. With performance like this, it isn’t surprising that passive index investors are growing ever more dominant:

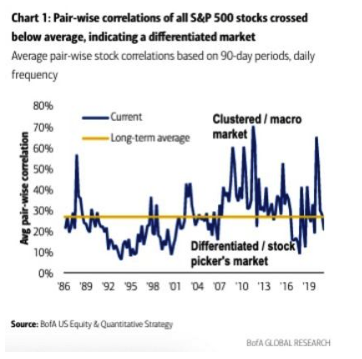

But as we have seen, the opportunities to beat the index are growing. (To be clear, the opportunities to lose to it are also growing — the key point is that when stockpicking doesn’t boil down to a decision on how much to trust the FANGs, stockpickers should have a chance to prove that they really are skillful.) Two factors crucially determine their opportunity. First is correlation; the less stocks are correlated with each other, the better the chance to stand out by choosing the right ones. In a crisis, everything tends to get correlated, which was certainly true last year. Now, as the following chart from BofA Securities Inc. shows, they have at least a decent shot to show their ability:

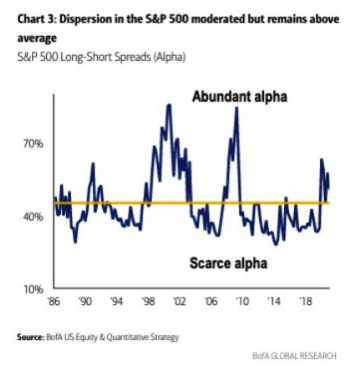

Second and possibly more important, stockpickers need dispersion. This refers to the amount by which stocks’ returns vary from each other. Stocks can have low correlation, but if they all buzz around in a narrow range it is still very difficult to beat the index after costs. As we have seen of late, dispersion has been its highest since the global financial crisis, and it remains above its long-term average:

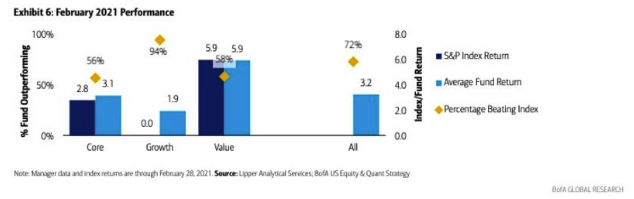

This has indeed translated into a spectacular change in active managers’ fortunes. In February, 72% of U.S. active managers beat their benchmark, according to BofA. Among growth managers, an amazing 94% beat the growth benchmark, possibly because they were virtually all underweight in Tesla Inc.:

To be clear, no sensible person would ever choose a fund on the basis of one month’s performance. Despite this, many people do exactly that. In the quite possible event that dispersion remains high with low correlation for another few months, there is that much more chance of a shift toward active managers again. That could be a big deal.