Anniversary League Tables

With Joe Biden addressing the nation on live television Thursday night, it seems that we are treating this as the one-year mark of the pandemic. So, here are two screen-grabs from the terminal to give an idea of what kind of money was there to be made for those who called the pandemic and its effects correctly. The dispersion was remarkably wide.

There are more than 1,500 companies in the MSCI World index. These are the top 10 in the 12 months of the pandemic, all of which gained more than 300%:

Some of those names, especially Moderna Inc. and Zoom Video Communications Inc., were virtually unknown back then, and there should be no surprise that Tesla is on top (though note from the first column that it is down slightly for the year so far). Enphase Energy Inc., less famous than some of the names around it, is a solar power producer. These are the bottom 10, again with some of the inadvertent “stars” of the pandemic:

It is no surprise to see a cruise company at the bottom of the heap, followed by airlines and oil companies. Galapagos NV, again a less familiar name, is a Belgian biotech group.

To see the opportunities both to make and lose money, note that Occidental Petroleum Corp. is the third worst performer in the MSCI World over the last 12 months, even though it is up almost 79% for the year to date.

Moves and changes of direction like this are very unusual. The opportunities to make and lose money are elevated — but ultimately, the case for minimizing costs and tracking the index seems even stronger after looking at these league tables.

Emerging Markets

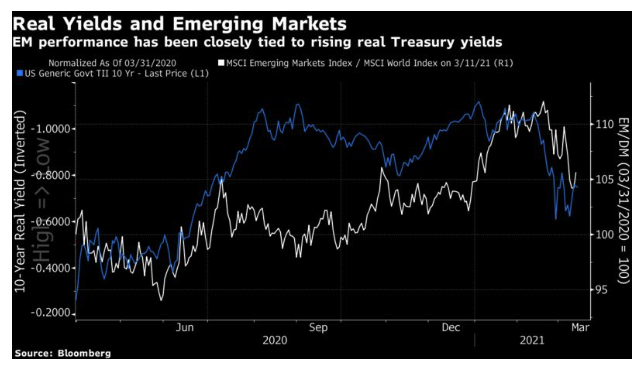

If there are clear losers from the rise in yields and the subsequent risk rotation, they are in the emerging markets. This rise in yields isn’t yet on the scale of the “taper tantrum” of 2013, and it hasn’t had as serious an impact on the emerging world. But it is having an impact. In the last few weeks, the performance of MSCI’s emerging markets index relative to its developed world index has overlapped almost perfectly with real Treasury yields — as these rise, emerging markets fall:

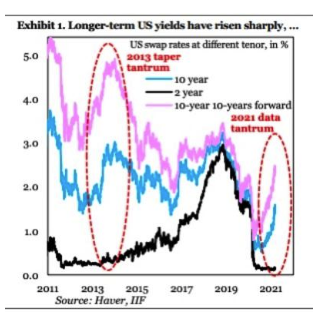

The following charts come from the Institute of International Finance, which suggests that this incident, the “data tantrum,” is at least worthy of comparison with what happened in 2013: