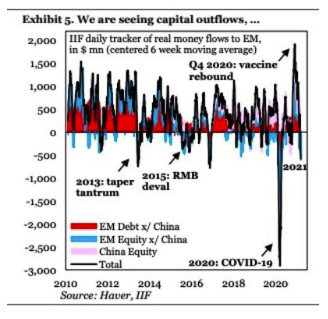

The IIF says that the violence of the rise in U.S. longer-term rates has led to sizable outflows from EM, which are now near levels last seen at the height of the taper tantrum with outflows concentrated in non-China markets.

Coming at a time when a belief in global reflation and a return of risk appetite should mean strong flows into emerging markets, the incident is testimony to the enduring power of the U.S. and its bond market over international capital flows. If yields rise, they will attract money out of emerging markets and into the U.S., come what may. This prompts the IIF into an appeal for a dovish shift by the Fed, as soon as possible:

Back in 2013, the taper tantrum ended when the Fed changed its rhetoric with a large dovish surprise in the form of the “no taper” at the September FOMC meeting. We think a similar shift in rhetoric is needed now. More guidance from the Fed on how the Q2 GDP rebound has few implications for the medium-term growth outlook will help anchor longer-term rates and keep financial conditions as accommodative as possible.

They may find that elusive unless there is a major selloff in U.S. equities, which seems to dominate the Fed’s reaction function at present. With the main U.S. indexes at or near all-time highs despite the violence of the rotation, that seems unlikely.

Thursday’s ECB meeting, in which President Christine Lagarde countered allegations that she’s lost control by stressing that she had the tools to limit any “undesirable” rise in European yields, did lead them to tick down in the U.S. as well. And this did indeed allow emerging market equities a day of outperformance. But the bottom line remains that emerging markets (outside China at least) remain at the mercy of capital flows, which in turn are driven by sentiment at the Federal Reserve and in the Treasury market.

Survival Tips

And for the ultimate in perspective, I recommend The History of the Entire World, I Guess, a 20-minute YouTube video which my son appears to know off by heart. It's very good and is one of the many things that has helped sustain us through a miserable 12 months. If you have any other nominations for a single best survival tip after the last 12 months, feel free to share them. And have a good weekend.

John Authers is a senior editor for markets. Before Bloomberg, he spent 29 years with the Financial Times, where he was head of the Lex Column and chief markets commentator. He is the author of The Fearful Rise of Markets and other books.

Now that we're a year into the pandemic, it's time for some context. This piece by Justin Fox shows that Covid-19 has been, indubitably, a lot worse than any of the postwar flu pandemics. Unfortunately, we don't and can't know how much worse it would have been without all the controversial attempts to mitigate it.