As the head of financial and economic research at Buckingham Wealth Partners for almost 30 years, one of the most common situations I’ve been asked to address is about clients with a heavily concentrated position (while 10%-30% has been common, concentrations of 50%-80% have not been unusual) in an individual stock (typically the stock of the company they work for). This is a mistake because, while holding a concentrated position is the surest way to create a great fortune, it’s also the surest way to lose one. And given that investors are on average highly risk averse (the pain of a loss is much greater than the joy of an equal size gain), this is not an attractive proposition.

This article begins with presenting the evidence that concentrating a portfolio in a single stock is playing what economists call a “loser’s game”—one that is possible to win, but the odds of success are so poor that it is imprudent to try. The winner’s game is diversification of risk. We’ll also provide the sources of the behavioral mistake of concentrating risk. With that knowledge and the evidence, hopefully investors will avoid the mistake.

The Evidence

Hendrik Bessembinder contributed to the literature on the returns to public equity investment and diversification benefits with his study “Wealth Creation in the US Public Stock Markets 1926-2019,” published in the April 2021 issue of The Journal of Investing. His data sampled included all 26,168 firms with publicly traded U.S. common stock since 1926. Among his key findings were that shareholder wealth creation was concentrated in a relatively few high-performing stocks. In addition, almost 60% of stocks reduced shareholder wealth. Bessembinder also found that just 4% of stocks produced all of the market’s excess return over Treasury bills. He also found that the 86 top-performing stocks, less than one-third of 1% of the total, collectively accounted for more than half the wealth creation.

Most stocks underperform the market as a whole over the long term, which arises from the positive skewness (lottery-like distribution) of long-term stock returns: While stock declines are limited to -100%, a few stocks can have extremely large positive returns. Prominent examples include 10-year market-adjusted returns of almost 20,000% for Cisco and Dell in the 1990s, and around 5,000% for Apple in the 2000s and Tesla in the 2010s.

Another important fact is that even the high-flying stocks eventually face limits in their ability to sustain above-market returns. As a firm grows, it attracts greater competitive and regulatory pressures.

A study by Longboard Asset Management, “The Capitalism Distribution,” covering the period 1983-2007 and the top 3,000 stocks, found evidence of the difficulty in continuing to produce great returns:

• 39% of stocks lost money during the period.

• 19% of stocks lost at least 75% of their value.

• 64% of stocks underperformed the Russell 3000 Index.

• Just 25% of stocks were responsible for all the market’s gains.

Investors picking stocks had an almost 2-in-5 chance of losing money even before considering inflation. They had an almost 1-in-5 chance of losing at least 75% of their investment, again before considering inflation. There was just more than a 1-in-3 chance of picking a stock that outperformed the index. Do you really want to bet against those odds with money you will need during retirement?

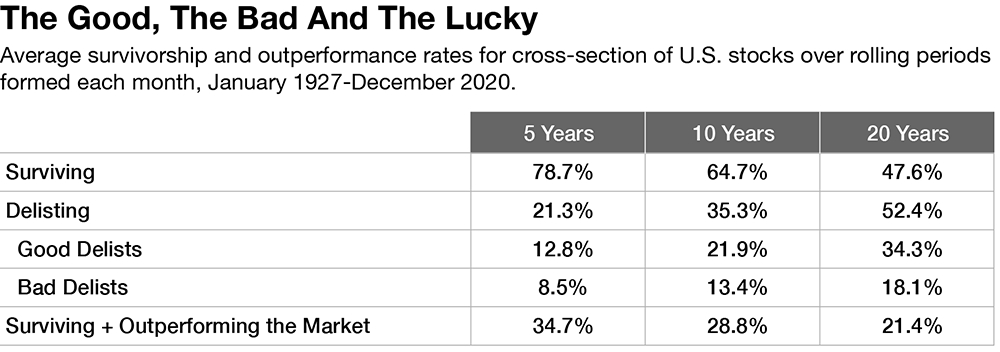

Bryan Ting and Wes Crill of the research team at Dimensional contributed to our understanding of the riskiness of individual stocks with their May 2022 paper, “Singled Out: Historical Performance of Individual Stocks. Among their key findings were:

• Only about a fifth of stocks survive and outperform the market over 20-year periods.

• Stocks delist at a high rate, even those that have been around for a long time and have outperformed the market for 20 years—the bad delist (due to deteriorating financial conditions) rate is still 3.0% even for past outperformers.

• The chance of any single stock outperforming the market in the future is not meaningfully different when conditioning on its past performance—on average, about 30% of the stocks that outperformed over the previous 20 years continued to survive and outperform over the following 10 years. And the same 30% that had underperformed over the previous 20 years went on to outperform over the following 10 years. In other words, winners have been no more likely than losers to beat the market in the future.

Antti Petajisto contributed to the literature on the risks of concentrated positions with his June 2023 study, “Underperformance of Concentrated Stock Positions.” His data sample was from CRSP and covered U.S. stocks over the period 1926-2022.

Following is a summary of his key findings:

• Since 1926 the median 10-year return on individual U.S. stocks relative to the broad equity market was -7.9%, underperforming by 0.82 percentage point per year. (Note the median return should be more important to risk-averse investors than the mean return.)

• For stocks that have been among the top 20% performers over the previous 5 years, the median 10-year market-adjusted return fell to -17.8%, underperforming by 1.94 percentage point per year.

• Since the end of World War II, the median 10-year market-adjusted return of the top 20% of stocks over the past 5 years was negative 93% of the time: “The odds are rather stacked against a concentrated position in a recently top-performing stock beating the equity market as a whole over the next ten years.”

• The mean return therefore showed a significant size effect, which was driven primarily by the underperformance of the biggest stocks rather than the outperformance of the smallest stocks. (Concentrated portfolios are often comprised of larger stocks due to their past strong performance, which is unlikely to be duplicated.)

• The median market-adjusted stock return was negative for all industries except finance, where it exactly matched the market return—this is a broad-based effect.

• The largest effect was in the business equipment and services group, which includes many of today’s technology-driven stocks, such as Google and Amazon: The median 10-year market-adjusted return was -18.4%, even though the equal-weighted mean return was positive at 20.6%. Healthcare stocks had a similar spread (37.2%). And many other industry groups had an over 30% spread between their median and mean 10-year returns.

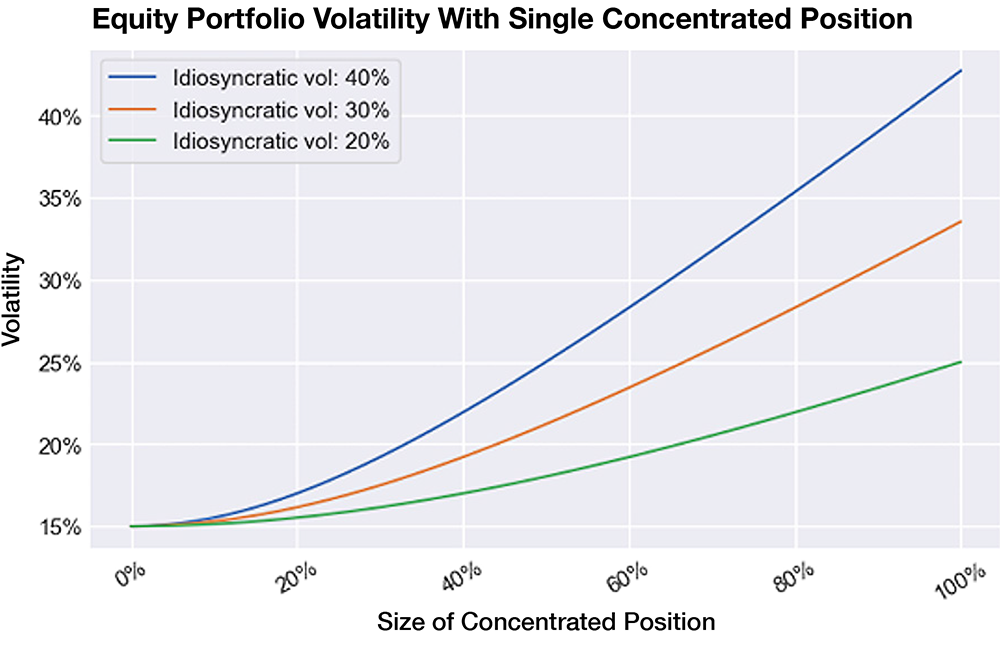

• Concentrated portfolios of greater than about 10% significantly increased portfolio volatility (Petijisto assumed market volatility of 15%).

Petajisto’s findings led him to conclude: “The case for diversifying concentrated positions in individual stocks, particularly in recent market winners, is even stronger than most investors realize.” He added: “When taxes and control rights are not significant factors, investors holding concentrated stock positions should seek to overcome the behavioral biases that often interfere with diversification plans. Diversification away from a concentrated stock position not only reduces portfolio risk but also boosts long-term returns in most cases, particularly when the concentrated position has a history of strong long-term performance. If the risk-reduction benefit of portfolio diversification is considered a free lunch, then the combined benefit of higher returns and lower risk from diversification is tantamount to getting paid to eat lunch.”

Given the historical evidence, why do concentrated positions exist?

Diversification: The Only Free Lunch In Investing

It’s been said that diversification is the only free lunch in investing because, done properly, an investor can reduce risk without reducing their expected return. Yet, despite this wisdom, many individuals hold concentrated positions in a single stock when they could easily diversify away that idiosyncratic, single-company risk. That begs a critical question: Given the proven benefits of diversification, why do so many investors hold portfolios with heavily concentrated positions?

We begin by discussing the difference between compensated versus uncompensated risks.

Compensated Versus Uncompensated Risks

In investing, it’s important to distinguish between two different types of risk: good risk and bad risk. Good risk is the type you are compensated for taking. Investors get compensated for taking systematic risks (risks that cannot be diversified away). The compensation comes in the form of greater expected returns (not guaranteed returns, or there would be no risk). Bad risk is the type for which there is no compensation. Thus, it’s called uncompensated, or unsystematic, risk.

Equity investors face several types of risk. First, there is the idiosyncratic risk of investing in stocks. This risk cannot be diversified away, no matter how many stocks, sector funds, or different asset classes you own. That’s why the market provides an equity risk premium.

Second, various asset classes carry different risk levels. Large-cap stocks are less risky than small-cap stocks and glamour (growth) stocks are less risky than distressed (value) stocks (at least in terms of classical economic theory). These two risks, size and value, also cannot be diversified away. Thus, investors must be compensated for taking them. This is the reason that the small stock and value stock premiums exist.

Another type of equity risk is the risk associated with an individual company. The risks of individual stock ownership can easily be diversified away by owning an index or other systematically managed fund that basically contains all the stocks in an entire asset class or index. And asset class risk can be addressed by building a globally diversified portfolio, allocating funds across various asset classes (domestic and international, large and small, value and growth, and even real estate and emerging markets).

Because the risk of single-stock ownership can be diversified away, the market doesn’t compensate investors for assuming unsystematic, idiosyncratic risk. And because the risk can be diversified away without lowering expected returns, the question is why so many investors hold concentrated portfolios.

While taxes are often a major factor in the holding of concentrated positions, we’ll discuss the myriad of behavioral explanations for this phenomenon as well as the reason why the behavior is a mistake (one that can prove very costly). Among the behavioral errors that lead to concentrated positions are:

• Confusing the familiar with the safe. Familiarity breeds overconfidence, leading to an illusion of safety. In contrast, the lack of familiarity breeds the perception of high risk. Overconfidence also leads to underestimating downside risks.

• Employees are often overconfident regarding the outlook for their own firm. Their familiarity leads to overinvestment. In the same way familiarity leads to the concentration of assets in an investor’s home country (referred to as home country bias, a global phenomenon), it also leads to overinvestment in the stock of the employer.

• Recency bias. Concentrated positions typically arise because of the recent spectacular performance of the stock. Recency bias, giving greater importance to the recent past, causes investors to ignore long-term historical evidence and to project the recent past into the future as if it is inevitable. The study “Excessive Extrapolation and the Allocation of 401(k) Accounts to Company Stock” found that strong past performance of an employer’s stock leads to overconfidence with respect to its future performance. Past performance was simply extrapolated into the future. However, great past performance usually results in high valuations. Thus, not surprisingly, participants who overweighted their employer’s stock based on past performance earned below average returns. That’s what happens when you fail to consider the price you pay for an equity investment relative to its expected returns. Great past returns typically lead to high valuations (high price-to-earnings, or P/E, ratios), which forecast low future returns.

• Anchoring refers to the tendency of people to pick an initial reference point and insufficiently adjust their estimate away from the reference point. That can lead investors to anchor their thinking around their baseline of current portfolio holdings, which can cause them to view a large reduction in a concentrated position as a radical move.

• Investors with large gains (which can create a concentrated position) make the mistake of believing they are playing with the house’s money. Here’s my favorite example of this phenomenon. A good friend of mine was either lucky or smart enough to buy Cisco at $5 per share. At the time, the stock represented a relatively small portion of his net worth. When the stock reached $80, his position in Cisco had become a substantial portion of his portfolio. I asked if he would buy any Cisco stock at the current price, and he said he wouldn’t. I then pointed out that if he wouldn’t buy any, he must believe that it was either too highly valued or he was currently holding too much of the stock, and it was too risky to have that many of his eggs in one basket. Despite the logic of the argument, my friend, one of the smartest people I have known, steadfastly refused to sell some of his shares for the following reason: His cost was only $5, and the stock would have to drop about 95% before he would have a loss. I pointed out that this was the same mistake gamblers make when they’re ahead at the casinos and keep playing because their gains are the ‘house’s’ money.” Of course, it’s not the house’s money. Having won it, it’s their money. And it’s a behavioral error, a result of a “framing problem,” to believe otherwise. A few months later, Cisco’s stock had hit $13, and my friend was still holding it.

• Investors sometimes treat the likely as certain and the unlikely as impossible. Despite even relatively recent examples (such as Enron, WorldCom, Lehman Brothers, and Bear Stearns), investors have a tendency to think that disasters can happen to other people and other companies, but not to them.

Another major impediment to diversifying is called the “endowment effect.”

Endowment Effect

Put yourself in the following situation. You’re a wine connoisseur, and you decide to buy a few cases of a new release at $10 per bottle. You store the wine in your cellar to age. Ten years later the dealer you purchased the wine from informs you that it is now selling for $200 per bottle. You have a decision to make. Do you buy more, do you sell off your stock, or do you drink it?

It turns out that when faced with this type of question, very few people would sell the wine, and very few would buy more. Given how expensive the wine has become, they might save it to drink on special occasions. This is not a completely rational reaction. The fact that you own the wine (the endowment effect) should not have any impact on your decision. If you would not buy more at a given price, you should be willing to sell at that price. The logic is simple. If you didn’t already own any, you wouldn’t buy any. Therefore, the wine represents a poor value to you and thus should be sold.

The endowment effect causes individuals to make poor investment decisions. Investors tend to hold onto assets they would not otherwise purchase because either they don’t fit into the asset allocation plan, or they are viewed as so highly priced that they are poor investments from a risk/reward perspective. The most common example of the endowment effect is when people are very reluctant to sell inherited stocks or mutual funds, or certain assets purchased by a deceased spouse. I’ve heard expressions like “I can’t sell that stock. It was my grandfather’s favorite and he owned it since 1952.” Or “That stock has been in my family for generations.” Or even “My husband worked for that company for 40 years; I couldn’t possibly sell it.” Another example of the endowment effect involves stock that has been accumulated through stock options or some type of profit-sharing or retirement plan.

Financial assets are like the wine bottles. If you wouldn’t buy them at the market price, you should sell. Stocks and mutual funds are not people. They have no memory, and they don’t know who bought them or how long ago. They will not hate you if you sell them. An asset should be owned only if it fits into your current overall asset allocation plan. And possessing it should be viewed in that context alone.

Investors can avoid the endowment effect by simply remembering to ask: If I didn’t already own this asset, how much would I purchase now as part of my overall investment plan? If the answer is that you wouldn’t buy any, or you would buy less than you currently hold, then you should develop a disposition plan.

The Tax Problem

A major issue that often leads investors to fail to diversify their concentrated position is the desire to avoid paying large capital gains taxes. Before addressing strategies to avoid or at least minimize that problem, I remind investors that there is only one thing worse than having to pay taxes—not having to pay taxes (as happened to those with concentrated positions in Enron, among many others).

Fortunately, there are strategies that can be used to avoid, or at least minimize, capital gains taxes.

For example, if there is a large taxable gain, you might consider donating the stock to your favorite charity. By donating the stock in place of the cash you would have given anyway, you can avoid paying the capital gains tax.

Another solution is to sell the shares and invest the proceeds in a leveraged long-short portfolio (perhaps 200% long and 100% short, for a net 100% equity position) such as the tax-aware, separately managed accounts run by AQR Capital. The net 100% position provides exposure to stocks, while the long-short positions provide a high level of certainty that lots of tax losses can be harvested (while the gains are deferred). Those losses can be used to offset the capital gains realized on the sale of the concentrated position.

Another strategy is to place the shares into a diversified portfolio consisting of the concentrated portfolios of other investors, called an “exchange fund.” These are pooled investment vehicles structured as partnerships, where multiple individuals contribute their concentrated stock positions in-kind to the fund and receive a proportional share of the overall fund in return. Since the investor isn't selling the securities, no capital gain is realized. If structured correctly, an exchange fund can result in converting single-security risk into a diversified portfolio that mimics the risk profile of a broad-based stock index without any capital gains realized. If you exit the fund in the future, you’ll generally receive a distribution of a basket of securities instead of cash. However, the IRS mandates a minimum 7-year holding period to receive that basket. Alternatively, you can keep your exchange fund shares and pass them to your heirs, who will receive a step-up in basis.

Unfortunately, we are not even close to completing our list of behavioral issues that lead to the failure to diversify.

A Laundry List of Behavioral Biases

The authors of the study “Human Capital and Behavioral Biases: Why Investors Don’t Diversify Enough” offered several other behavioral explanations for the failure to diversify:

• The Endorsement Effect: Participants in 401(k) plans are influenced by an employer match made in company stock. They consider the match in stock an endorsement and take it as a positive signal to invest in the company. The same thing is true of stock grants and stock options.

• Cognitive Dissonance: We all want to feel good about our career choice and our employer. That leads to employees choosing to believe that a firm’s prospects are bright. Choosing not to believe this leads to angst and self-doubt. This, in turn, can result in an overly optimistic assessment of a firm’s prospects and concentration in that firm’s stock.

• Appeal to Authority: Many people tend to automatically obey or believe those whom they regard as holding positions of authority. Thus, employees overweight the optimistic statements that executives make about their company.

• Choice Overload: Various studies have shown that participants are often overwhelmed with information regarding the many investment choices in their retirement plans. An easy way out is to take the familiar option, in many cases company stock.

• Commitment Bias: Selling company stock can be seen, or felt, as a sign of disloyalty.

• Confirmation Bias: We have the tendency to overweight evidence that confirms our views and ignore evidence that is contrary to them.

• Herding: Few people have the ability to fight the herd. Most would rather follow it. One reason is that they are concerned about how others will assess their ability to make good decisions. The fact that other employees own large positions in company stock influences their decision to do so as well. Herding is also an excellent reason to avoid what I like to refer to as ‘water cooler’ investment advice. Don’t discuss investments with fellow employees because academic research has found this leads to poor decisions.

• Regret Aversion: We are concerned about the distress we’ll feel if we make a decision we come to regret. This leads to employees maintaining concentrated positions in order to avoid the emotion they would feel if they sold company stock and it later rose sharply.

• People make investment decisions based on what they believe is important information, or what economists call “value relevant” information. They virtually never consider that other investors, with far more resources, almost certainly have the same information. Information they have must already be “baked into” prices. Mark Rubenstein, a professor of applied investments at the University of California, Berkeley, put it this way: “One of the lessons of modern financial economics is that an investor must take care to consider the vast amount of information already impounded in a price before making a bet based on information.” Legendary investor Bernard Baruch put it more succinctly, stating: “Something that everyone knows isn’t worth knowing.” The failure to understand this leads to a false sense of confidence, which in turn leads to a lack of diversification.

• Investors sometimes have the false perception that by limiting the number of stocks they hold, they can manage their risks better.

What many investors fail to consider is that the failure to diversify can cause not only the loss of financial assets but can also create the risk of “double jeopardy.”

Double Jeopardy

While concentrating investments in a single stock is imprudent, the mistake is often compounded by investors who further choose to concentrate their financial assets in their employer’s stock. As we discussed previously, an investor’s familiarity with their employer may cause them to believe that their firm’s stock is a less risky investment than, for instance, a globally diversified portfolio of mutual funds that contains thousands of stocks.

This is clearly a behavioral error, especially when we consider two potential outcomes. The first is one in which the company does well. If that is the case, the employee also will likely do well regardless of whether he owns lots of company stock. The outlook would be bright for pay increases, bonuses, promotions, and perhaps even more stock options or stock grants. On the other hand, if the company does poorly, the employee could face a double whammy. Not only will his portfolio take a devastating hit, but he may find himself without a job due to layoffs, or even bankruptcy.

Concentrating assets by putting both your labor capital and financial capital in the same risk basket is playing a game of double jeopardy. And that’s why, while concentrating the two risks may provide the best chance of creating a fortune, it’s also the surest way of blowing the fortune. And prudent investors know that understanding the consequences of decisions should dominate the probability of outcomes no matter how good you estimate the odds to be. That understanding helps avoid the behavioral mistakes humans are prone to make.

While diversification is clearly the prudent strategy, the potential for outsized rewards (however improbable) may sway some investors to take the lottery-like risk anyway and buy individual stocks.

Investor Takeaways

Concentration brings both the opportunity for great returns and the agony of disasters. For investors who have a relatively low marginal utility of wealth (which is true of most high-net-worth individuals, the very ones who tend to have concentrated portfolios) and thus should be risk averse (having already “won the game” by achieving sufficient financial wealth to maintain a more-than-acceptable lifestyle), having concentrated positions is an imprudent risk.

We have reviewed a long laundry list of behavioral biases that result in the failure to diversify. By definition, behavioral biases are irrational. Thus, they should be resisted, something that is easier said than done. However, the first step in avoiding them is to be aware of the biases—and now you are. Knowledge is the armor that can protect you from biases.

As Petijisto noted in his paper, at times there may be valid reasons to not liquidate, such as taxes and loss of voting rights and even control. However, “not diversifying does come with a nontrivial cost, as this paper has shown, so concentrated stock investors should evaluate the costs and benefits of taking at least incremental steps toward diversification.”

And finally, the empirical evidence on concentrated stock positions demonstrates that increasing diversification not only reduces portfolio volatility but also usually increases portfolio return. Thus, my advice is that if you find yourself with a concentrated position, don’t just sit there, trapped into inaction by the biases we’ve discussed. Take action. Or one day you might find that you have turned a large fortune into a small one.

Larry Swedroe is the author or co-author of 18 books on investing, including his latest, Enrich Your Future: The Keys to Successful Investing.