A potentially explosive battle is brewing over a seldom-discussed aspect of the looming MiFID II laws, which will force traders of any European asset class to hand over personal identification such as passport numbers to every venue they trade on.

The massive data-collection exercise will drag in tens of thousands of investors and traders, who some trading venues say may simply refuse. A client mutiny would leave platform operators stuck between cutting off their customers or breaching the European Union’s Markets in Financial Instruments Directive rules when they kick in on Jan. 3.

“The whole issue around personal data has been underestimated,” said Enrico Bruni, managing director, head of Europe and Asia at Tradeweb LLC. “There are three problems: There’s an administrative problem for having to manage this data, there’s a philosophical problem about whether it’s right to collect this data. And, potentially, a legal problem.”

The hunt for data starts on Oct. 27, when Cboe Global Markets Inc.’s European exchange, formerly known as Bats Europe, becomes the first major market to switch on its MiFID-ready platform. London Stock Exchange Group Plc and others will follow in November, hoping to gather the data in less than two months.

That will prove impossible for citizens of countries with strict privacy laws. In Switzerland, for example, it’s illegal to supply passport numbers to a commercial organization. The EU’s regulators insisted on putting a personal-data requirement in MiFID II because they wanted a means of more quickly identifying individuals in cases of suspected market abuse.

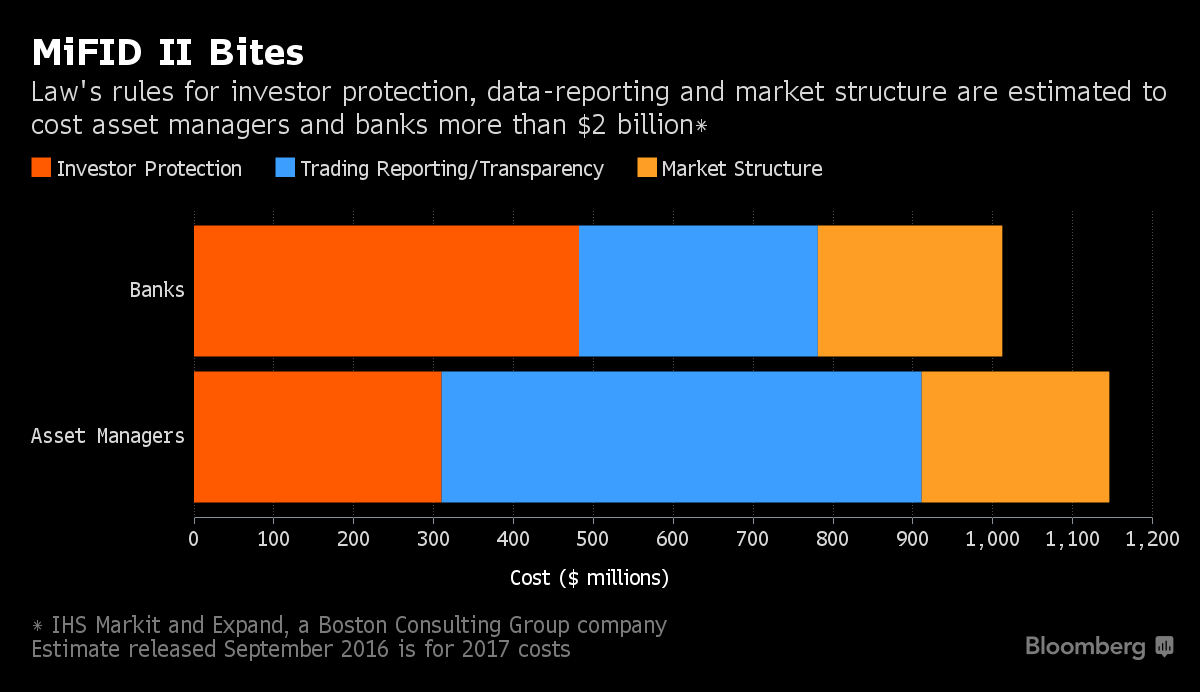

Costs are another worry: about half of the more than $2 billion banks and asset managers will spend on MiFID will be on trade reporting and transparency requirements, according to IHS Markit and Expand, a consultancy owned by Boston Consulting Group.

Trading venues say they simply don’t know how many of their customers will refuse to follow the rules. Fixed-income and currency-derivatives markets might be hardest hit. The average bond-trading venue has several thousand members, all of whom will need to supply data. Stock exchanges have it easier. Cboe’s European venue, for example, has just 150 members.

Less Convincing

Convincing Asian firms to hand over client data is also proving a headache, says Katten Muchin Rosenman LLP’s Nathaniel Lalone.