Meanwhile, the low rate/high asset price environment removes the impetus for corporate frame breaking changes, and so low productivity businesses are “allowed” to just muddle along, restraining the Shumpeterian forces necessary for growth. In short, fundamental problems are systemically ignored by the collective. So, if you happen to see an emperor strolling about, happy and stark naked, you just shrug and move on.

But the worm will turn. It always turns. The collective gets jolted out of its slumber and suddenly realizes that capital is surrounded on all sides by clear and present dangers. The torrent of capital that flooded in under the FOMO banner may well become the most formidable ebb tide!

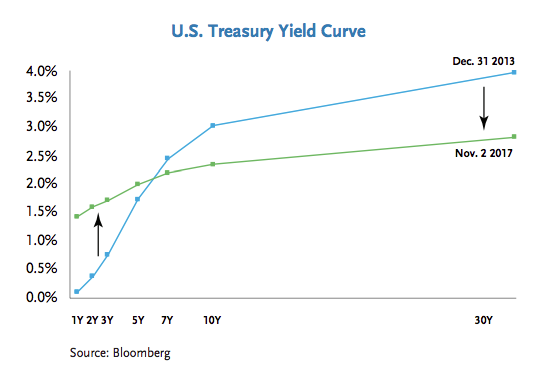

Before concluding one of our typical (i.e., informative and cheery) discussions, it’s worth a brief reminder that markets “vote” in the short-run and “weigh” over the long-run. Equities, real-estate, and bonds with “hair” have all voted, and we know how that has turned out. Meanwhile, we may not have heard enough from one of the most reliably smart guys in the financial markets. He seems to do a pretty good job of “weighing” and has one of the better (though far from perfect!) track records of forecasting recessions. Never heard of him? Oh, yes you have: he’s the yield curve, of course:

Stocks roar to new highs. Tax cuts advance in Congress, I think. Consumer confidence revs while unemployment plumbs its lowest levels in decades. Yet, the yield curve just doesn’t seem to be buying it. Perhaps he has lost his mojo. On the other hand, even if he has misplaced his crystal ball, a flattening yield curve does more than just signal that growth and inflation prospects are viewed skeptically. A flatter curve squeezes the term premium out of the equation for virtually all financial intermediaries. Less term premium means less net interest margin (NIM). Less NIM dis-incentivizes credit formation. Indeed, should term premia continue its vanishing act, we might find that it was the yield curve that helped put the “de” back into “de-leveraging.” Proceed with caution!

Tad Rivelle is chief investment officer, fixed income, the TCW Funds and MetWest Funds brands.