Tipping is terrible. Almost no one likes it. And as it has become more ubiquitous, it has also become even more unpopular.

Undeterred by any of this, Donald Trump has an idea sure to make tip jars and in-app tip requests even more common: In a speech last week in Las Vegas, he said he would make tipped income tax-free. As a result, more pay would likely be defined as tipped income. Not only would that bring in less tax revenue at a time when it is sorely needed, it is also bad economics.

The normal justification to make certain types of compensation tax-advantaged or tax-free, such as 401(k) contributions or health insurance premiums, is to encourage their use. Society as a whole is better off when more people save for their retirement and get health care (although even then, the case for preferential tax treatment is weak and has proved distortionary). There is no economic justification to favor tipped income over regular income. If anything, it should be taxed more, because it is not a good way to pay people.

Tipping 20% or even 25% of the bill to restaurant servers is common in the US. At first, when the custom was imported from Europe in the early 1900s, it was a modest and sensible way to motivate good service. Over time, however, the size of the expected tip grew, and tipping became the norm regardless of the quality of service.

Tipping is now internalized as a cost of doing business. That means a quarter to a fifth of restaurant revenues go directly to the server rather than to the business itself. Owners thus have less money to allocate among staff based on the value of their skills or their scarcity in the labor market—the way it works in every other business.

This creates a distortion in the service industry. According to one estimate, servers in upscale restaurants make 80% more than the back-of-the-house staff—even though the entire staff contributes to the customer experience, and being a chef requires more training and education. Trump actually tried to address this imbalance when he was president, by making it easier for employers to pool tips and redistribute them to the staff. It is not clear if his plan to make tips tax-free would apply to pooled tips, too.

Tipping is worse for servers at lower-end restaurants, where meals are less expensive and there isn’t always a steady stream of customers. For these waiters, tipping means less predictable income compared to what they might get with no tips and a higher wage.

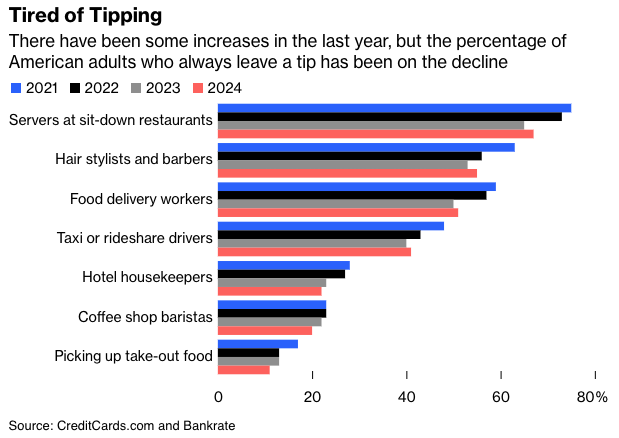

Customers also feel burdened, as tipping is starting to feel more like a social obligation that increases both costs and anxiety. One survey suggests the increasing resentment may mean more Americans no longer tip in what used to be standard tipped transactions—such as a meal at a sit-down restaurant.

It all adds up to a tipping system that is disliked and resented by everyone, with the possible exception of waiters at high-end restaurants. This helps explain why restaurateur Danny Meyer, after famously trying to phase out tipping in his restaurants almost a decade ago and incorporate them into the cost of the meal, had to retreat: His servers hated the policy.

If Danny Meyer, one of the most powerful people in the industry, can’t end tipping, then what hope is there for any restaurant owner?

And it is only getting worse: Inflation, pricing pressure and high labor costs are squeezing owners who are already operating on small margins and unable to increase prices or wages. So servers ask for tips instead, and now it feels like every transaction involves someone or something asking for a tip.

The only way to end tipping is through policy change. And the policy is definitely not to encourage more tipping by giving it tax advantages. It’s to make tip pooling the norm or, better yet, to phase out tipping entirely.

Maybe it’s not a policy a presidential candidate would want to propose in a speech delivered in a swing state with a big service economy. But it’s something everyone in the rest of America might appreciate.

Allison Schrager is a Bloomberg Opinion columnist covering economics. A senior fellow at the Manhattan Institute, she is author of An Economist Walks Into a Brothel: And Other Unexpected Places to Understand Risk.

This article was provided by Bloomberg News.