Investors looking to real estate as a source of yield are closely following the unfolding global macro-economic landscape. Although real estate is typically more exposed to local economic factors, macro elements can disrupt projected returns.

In general, REITs are expected to deliver mid- to high-single-digit yields, reduced risk due to stable, long-term rents, and low correlation to equities. These expectations, though, could be in jeopardy should harmful macro factors weigh on real estate investments.

Under normal conditions, macro factors do not typically impact the entire global market. As such, selecting a real estate investment based in a more desirable geography can allow investors to avoid harmful macro factors.

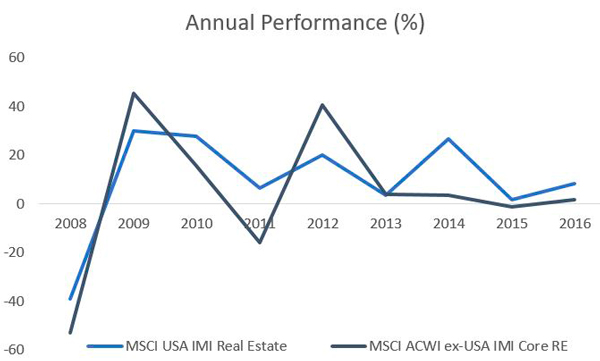

This can explain the recent returns of U.S. REITs compared with those from international markets. Over the past five years, U.S. REITs have outperformed global ex-U.S. REITs by more than 2.5 percent according to data from MSCI. Moreover, U.S. REITs offered lower volatility.

But recent market moves point toward a potential reversal of this trend. Global ex-U.S. delivered a return of 5.48 percent year-to-date through February 16, significantly higher than the 1.50 percent offered by the U.S., with comparable yields. According to CBRE Group’s global chief economist Richard Barkham, the outperformance of global ex-U.S. markets makes sense.

“I am optimistic for investment in both the U.S. and non-U.S. markets,” Barkham says. “Debt is readily available and there are good growth drivers. But in the U.S. expectations of rising interest rates and a stronger U.S. dollar will constrain the market a bit.”

Conversely, he notes that investors are interested in Europe. “Fundamentals of limited new supply, good demand for space and no expectation for rising interest rates, we believe, will propel Europe to outperform the U.S., although by not very much,” Barkham says. “Asia Pacific is impacted by a slowdown in China. There you see relatively compressed capitalization rates and more aggressive supply leading to weaker, but not negative, rental growth. We expect positive returns in Asia Pacific, but less than Europe and the U.S.”

REIT Comparison