Mobilizing private sector support for the SDGs will require solid evidence that such investments can pay adequate returns. There are reasons for optimism here. According to a recent comprehensive study from the Copenhagen Consensus Center, investing equally across all 169 individual SDG targets would yield $7 in benefits for every dollar invested. Focusing on the targets with the highest-expected social payback could boost that return on investment fourfold. That’s a powerful incentive.

In many cases, governments are also likely to implement financial or regulatory incentives to encourage such private sector participation. Companies are also coming under increased pressure from investor-led groups to pay more attention to sustainability issues. In our view, the goals that offer both financial incentives and positive social outcomes are likely to see the most rapid progress while those offering more limited profit potential will be achieved more slowly—and may ultimately be addressed through the non-profit sector (NGOs) and/or governments.

How Are We Doing So Far?

With efforts to establish standard benchmarks still being ironed out, it’s too soon to say how far along we’ve come. A recent study analyzing SDG progress found that we are on track to achieve only three of the 17 targets today. The rest will require significant reforms (nine of the 17) or an outright reversal of current trends (five of the 17).

This state of affairs should not be viewed as overly discouraging. Given these very long-term goals, and that many companies are investing to capture the potential profits associated with them, we believe that investors can build a portfolio to capture this opportunity. If we were on track to meet all of these aspirational goals after just one year, there wouldn’t have been much need for setting them in the first place. We also wouldn’t make light of the fact that 193 nations came together, in rare solidarity, and agreed to this set of goals. These are shared priorities, and we expect continued headway in fulfilling them.

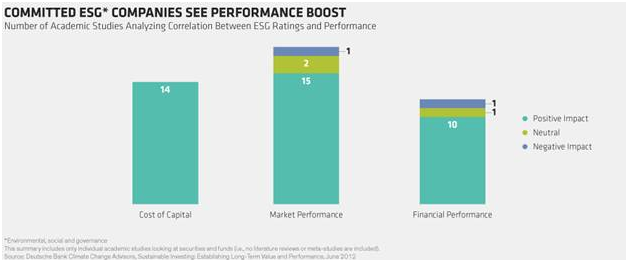

Constructing a portfolio around this 15-year global agenda offers investors huge potential, in our view. A large and growing body of academic research shows that companies with strong environmental and social policies and practices have lower financing costs, improved financial results and superior market performance (Display).

Sustainability Makes Economic Sense

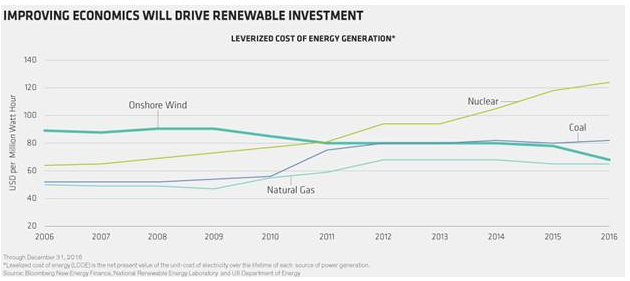

The political headwinds to SDG progress are omnipresent and look likely to intensify under the new U.S. presidential administration. But it is important to remember that the sustainability movement is a growing global phenomenon with deep-rooted public support. Donations to social and environmental causes have surged in recent years, and investors across the globe are far more ESG-aware today. In particular, we expect the economic case for renewable energy to gain momentum in the years ahead as the costs of wind and solar power continue declining (Display). Leading wind player Vestas, for example, received 18 new wind turbine orders in the last three days of 2016, with December orders totaling a record 2.8 gigawatts. Notably, eight of those orders were placed by U.S. customers.