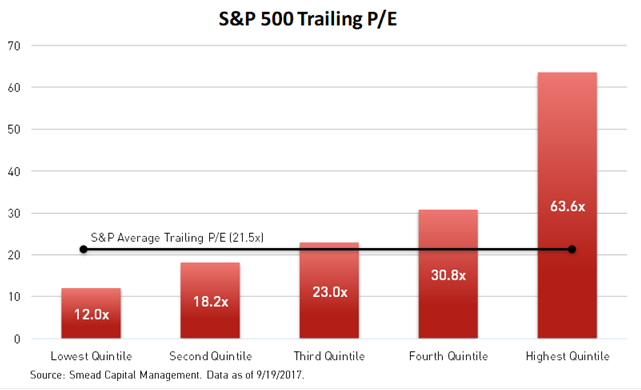

What has developed the last ten years is a very bifurcated market like the ones which existed in 1972 and 1999. High P/E stocks dwarf less expensive stocks in price and by market capitalization (see chart below):2

If Lazarus (value investing) wants to rise from his (its) tomb, some combination of the following must happen:

1. Energy and other asset-rich companies must do better in the lowest P/B quintile.

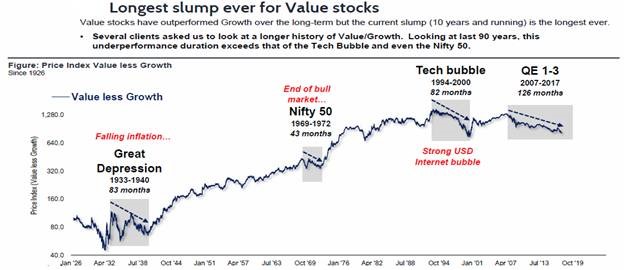

This long-term chart shows the history of value beating growth and gives us clues on how this episode could play out:3

We believe the challenge for us as value investors with a qualitative bent is to beat the index the next ten years when value (especially low P/B value stocks) rebounds relative to the rest of the S&P 500. Some of the biggest and longest underperformance episodes for value have been followed by big stock declines in the aftermath of glamorous growth stock eras (1973-1974 and 2000-2003). Eras of anemic economic output like 1933-1940 and the recent episode from 2007-2017 would need to end for value to succeed. In our stock picking discipline, we welcome all environments and enjoy the challenge in whatever the future holds for common stock investors. We believe value investing never dies, but it does hibernate in the tomb longer than we and many value oriented Mary’s and Martha’s would like.

William Smead is CIO and CEO of Smead Capital Management.

1. Source: The Wall Street Journal

2. Consumer discretionary stocks (retailer, auto, media, etc.) and financial stocks must do well in the lowest P/E quintile (61 out of 100 companies in the current list).

3. Stocks in the two highest P/E and P/B quintiles must do poorly in relation to average and inexpensive stocks.

4. The economy must strengthen and/or interest rates must rise and normalize.

2. Source: Smead Capital Management

3. Source: Fundstrat “Value continues to gain traction, Value Cyclicals leading turn” published September 22, 2017.