Over the past few years, even as they have been gritting their teeth and complaining about higher prices, consumers have been fueling U.S. economic growth. Now their pandemic savings are gone and the labor market is cooling off, raising the question: How much will the economy slow down?

First, two points: One, economic growth has shocked repeatedly on the upside, beating expectations for growth quarter after quarter since the pandemic recovery began in 2020. The economy is bigger today than forecasters such as the Congressional Budget Office predicted even prior to the pandemic. Two, households entered this year with more consumer purchasing power than they had prior to the pandemic.

And yet frustration with inflation over the past few years soured Americans’ views of the economy, even as their real consumption and economic well-being grew. The result was lowered consumer sentiment and false predictions of recession.

This history of pessimism presents a new risk for the U.S. economy. Have we been crying wolf for so long that we will fail to see the actual wolf at the door?

The first step is to realize that consumer sentiment has simply become a less reliable predictor of consumers’ behavior. So while sentiment has been improving, this doesn’t necessarily mean that spending will stay strong throughout 2024.

Instead, the focus should be on consumers’ ability to spend.

Consumer spending has been partially driven over the past three years by excess savings accumulated during the pandemic, which reached a peak of $8,000 per adult in August 2021. Similarly, broader measures of net worth also surged in 2021. These savings are fully depleted, as are the gains in net wealth.

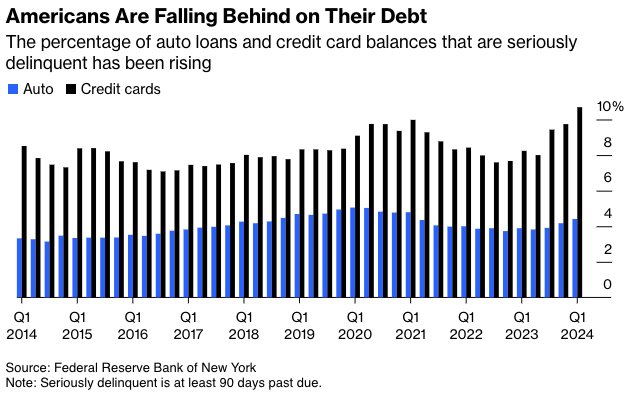

Consumers are no longer going to be able to rely on past income to fuel current spending. While the higher interest rates did little to discourage consumers from spending money they already had, they are more likely to deter spending from future income—that is, borrowing. High interest rates make debt more expensive. Consumers are already showing signs of trouble managing their debt: Serious delinquency rates for auto loans and credit cards are rising and are above 2019 rates for most age groups.

With excess savings gone and higher interest rates limiting borrowing, consumers are more reliant on current income to fund their purchases. The strong labor market over the past few years drove gains in household incomes across the income spectrum, giving a strong base for ongoing spending. But a slowdown in spending can weaken the labor market, driving down economic growth.

Recent data showed that consumer spending slowed in the first quarter of 2024 more than initially thought. The travel industry is counting on Americans continuing to make up for missed vacations during the pandemic this summer. But as one of the last industries to recover from the pandemic, travel might not be the most forward-looking indicator of consumer spending. Spending on goods has already flatlined. Most spending growth is now concentrated in services, which are going strong.

Traditionally economists and Fed watchers have viewed the number of jobs added each month with a perversion that confuses ordinary people: A big number is seen as bad news. The theory is that if employers hire too many workers now, there will soon be a shortage of workers, pushing up wages, which will eventually drive prices higher, leading to a rise in the rate of inflation.

But the past few years have confounded these expectations, partly because it is hard to predict how many new immigrants and people currently out of the labor force will enter the labor market to meet employer demand for workers. These workers have contributed to months of high job growth with little sign of wage growth driving ongoing inflation. Instead, there was a virtuous cycle: Consumers wanted to buy things, and new businesses and workers showed up to meet that demand. The immaculate disinflation was helped, rather than hurt, by a strong and dynamic labor market.

Now that dynamic labor market is disappearing. Unemployment remains low, but it is rising. Perhaps more concerning, fewer workers are quitting jobs—the quit rate has fallen back to rates last seen in 2018 and the hire rate has fallen by even more, hitting a low last seen in 2017.

Instead of cheering a labor market that is cooling down, the Federal Reserve needs to be prepared to react. If the labor market slows too much in response to a cutback in consumer spending, Americans will likely spend even less. It is the Fed’s job to make sure that this doesn’t become a vicious cycle. If it gets it wrong, the U.S. could be stuck with inflation above the Fed’s target or a painful recession.

This is a challenging moment for monetary policy, and the Fed can’t let itself get distracted by the false warnings of recession that have clouded economic discussions over the last few years. Instead, it needs to focus on the reasons that consumer behavior has been unusual. Consumers have been more resilient than expected to high interest rates, and so these high rates slowed the economy less than expected. But the reasons for that resilience are evaporating, and the Fed will need to pay careful attention to the signs of a slowing economy.

Betsey Stevenson is a professor of public policy and economics at the University of Michigan. She was on the president’s Council of Economic Advisers and was chief economist at the U.S. Department of Labor.

This article was provided by Bloomberg News.