Bruns said he was fired two months after complaining to the bank’s ethics hotline about his colleagues’ sales practices.

Broad Review

In the statement, Wells Fargo said it takes allegations such as Bruns’s seriously and will examine them thoroughly. The San Francisco-based bank has policies prohibiting retaliation for reporting suspected misconduct, and it’s conducting an “an end-to-end review” of the hotline process. The company said Thursday in a quarterly regulatory filing that the Securities and Exchange Commission is among the authorities examining its sales practices.

More broadly, the lender said it’s taking a hard look at what happened.

“The company’s leadership is intently focused on restoring trust in its community bank, making things right with customers and taking actions intended to ensure sales-practices issues do not happen again,” Wells Fargo said. “Actions have included naming a new head of retail banking, eliminating product-sales goals and changing the retail bank’s risk-management processes and protocols for customer-account activity. As we have disclosed, there are multiple investigations under way to address sales-practice issues, including by an independent committee of the board of directors. The integrity of these investigations is not served by commenting on speculation and rumor. The company will take accountability actions, as appropriate, once it has the facts necessary to act.”

The scandal exploded in September with the announcement of $185 million in fines, prompting John Stumpf to step down weeks later as chairman and chief executive officer. Carrie Tolstedt, who oversaw the consumer unit from 2006 until July this year, also left. Together, they’re giving up about $60 million of unvested stock. Neither responded to messages seeking comment.

The bank’s board has publicly promised to investigate how fake accounts proliferated, potentially punishing more executives as warranted.

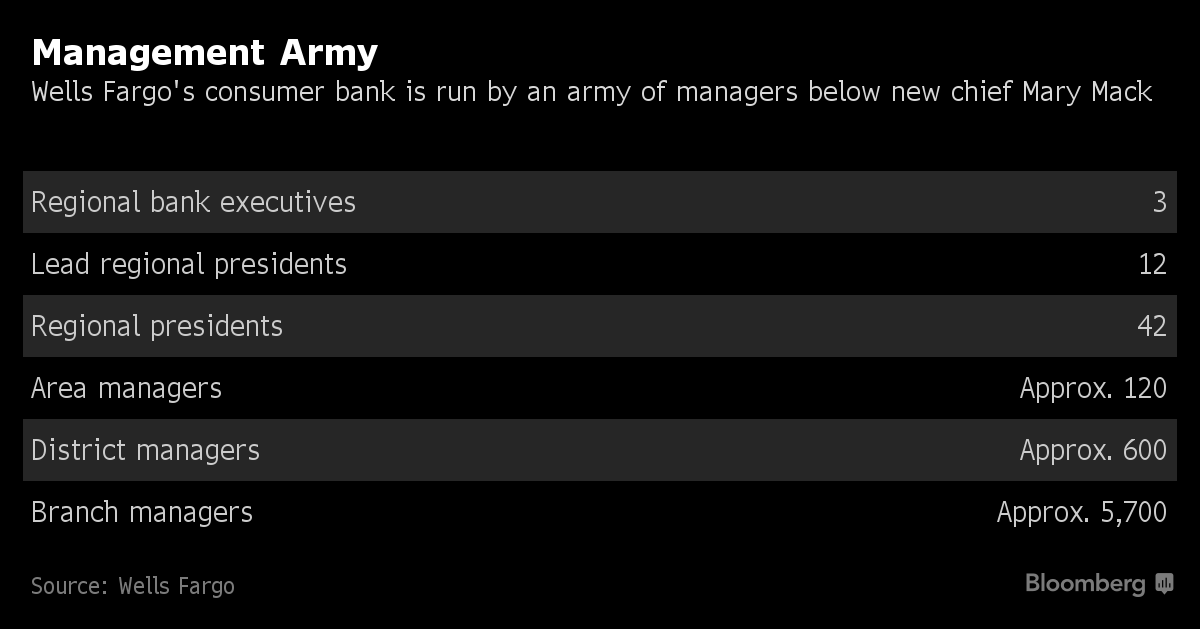

That’s a monumental task: The firm’s most recent annual report shows the community bank’s three U.S. regional chiefs oversee more than 50 regional presidents. Below them, there are about 120 area presidents, each with their own cluster of branches.

The bank terminated only one member of that army -- an area president -- for improper sales over half a decade while firing more than 5,000 lower-level workers, Stumpf said while testifying to a U.S. Senate panel in September.

One question lawmakers want answered is whether any of those who remain ever directed employees to open accounts without customers’ permission or ignored such misconduct, which authorities have said was widespread. The board’s review is expected to take months, according to a person with knowledge of the process. A board spokesman declined to comment.