“We failed to acknowledge the role leadership played and, as a result, many felt we blamed our team members,” Stumpf’s successor as CEO, Tim Sloan, said in a speech to staff on Oct. 25. “That one still hurts, and I am committed to rectifying it.”

At the heart of Wells Fargo’s sales culture was a metric developed by top brass more than a decade ago, tracking how many financial products and accounts -- now dubbed “solutions” -- branch employees sold daily. Back then, the focus appeared to be different.

Les Biller, chief operating officer from 1998 to 2002, mainly used the figure to set staffing levels, one former senior manager said. If employees fielded more than a certain number of solutions daily, it might signal more tellers were needed at an overworked branch. Biller didn’t respond to messages seeking comment.

‘Motivator Report’

Under Tolstedt, 56, sales volume was the ultimate measure of performance, former employees said. Managers urged workers to boost daily sales and persuade each customer to sign up for more Wells Fargo products, a practice known as cross-selling.

Tolstedt ran the division with a style that former colleagues describe as intense and driven, and unrelentingly focused on numbers showing growth. Branch personnel were assigned sales targets that, for years, kept climbing. Their progress was tracked in what some called a “Motivator Report,” which circulated daily to managers. It set the tone for conference calls, in which supervisors pressed people below them to meet quotas.

Stumpf brought them up, too, e-mailing high-performing managers to congratulate them and often citing their figures when stopping by local offices, according to one former manager.

The bank has said it took steps to prevent cheating, such as increasing ethics training and lowering targets to win bonuses. One manager credited Tolstedt for introducing more metrics to track customer service and satisfaction, emphasizing a need for quality.

But for many, the focus on hitting or beating quotas was a monster that underperformers dreaded and the ambitious tried to lasso. Managers who boosted sales typically rose fastest, and some talked incessantly about strategies for doing that, the employees said.

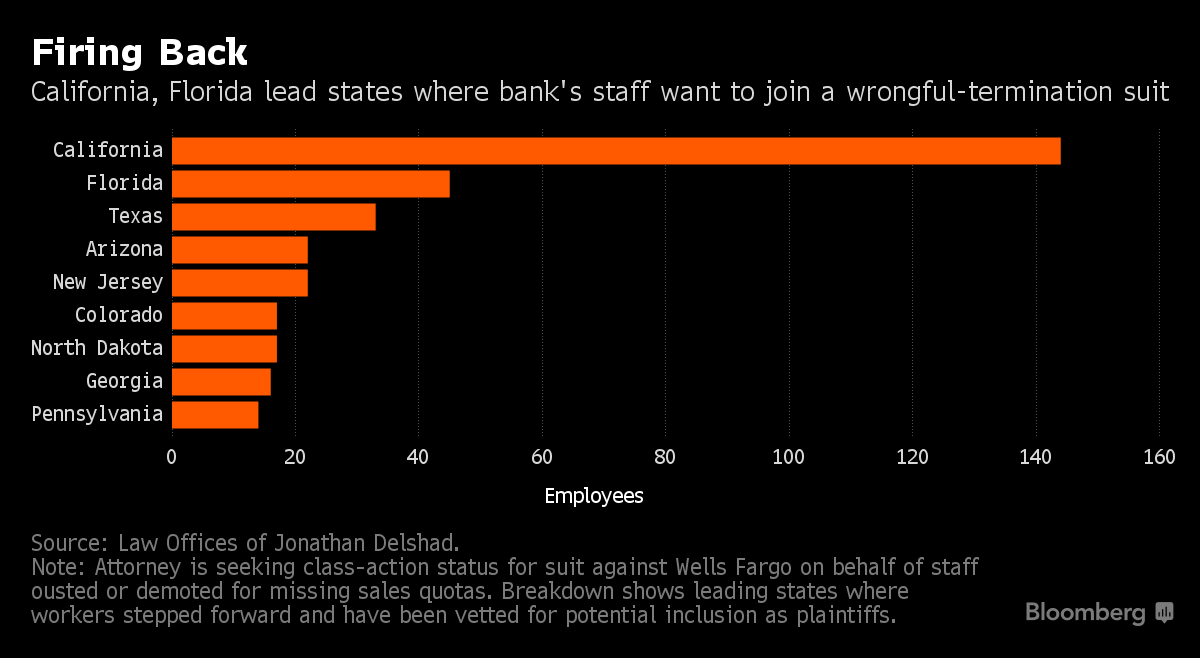

Stories of Southern California bankers opening 42 debit cards in a single day percolated among astonished managers in other areas, one person recalled. Several managers who tried to gauge their progress relative to peers said California and Florida often stood out for their new accounts, though many of them were hardly used.