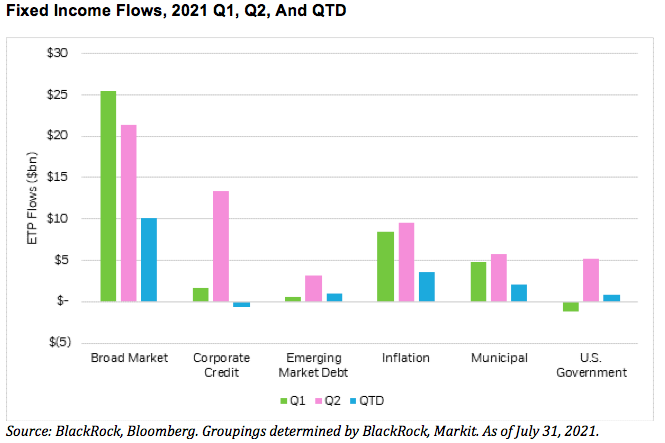

We have also seen a quality bias emerge within fixed income ETFs as flows into U.S. government bonds rose in Q2 to $5.3bn compared to Q1 outflows of $1.2bn. A resurgence in Q2 corporate credit inflows saw investment grade exposures take the lion’s share of assets, taking in nearly double those of high yield ETPs.

In Q1, $8.5bn flowed into inflation-protected fixed income ETFs only to pick up momentum in Q2 with $9.6bn in net inflows. Q3 has seen similar inflation-hedging activity, adding $3.6bn in net assets quarter-to-date.

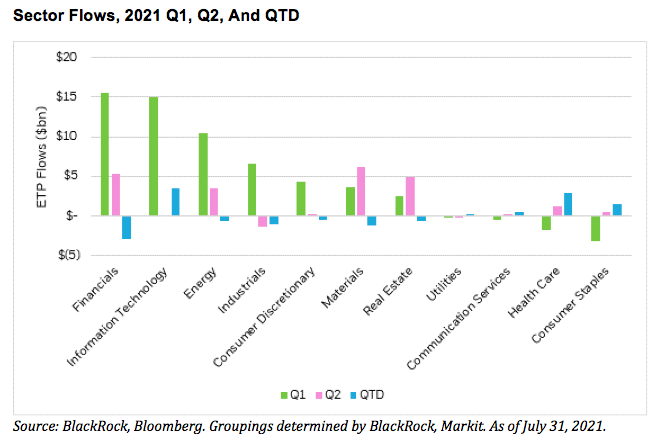

Sectoral flows paint a similar picture, with Q1 flow gatherers such as value-oriented financials, materials, and energy all seeing outflows in Q3 to date as rates moved lower in July. Meanwhile, healthcare and technology—both backbones of the quality factor—have enjoyed greater inflows in Q3 to date than seen in Q2, and after healthcare saw outflows in Q1.

To be sure, reflation remains with us, with June core CPI reading at an elevated 4.5% YoY, core PCE rising to 3.54% (the highest since 1991), and with Bank of America pointing out that mentions of “inflation” on Q2 earnings calls topped Q1 levels and jumped to a record high, rising over 1000% YoY (outpacing the 900% increase seen last quarter). In this reflationary regime of growth peaking but inflation staying elevated, quality-oriented companies may stand to benefit as their pricing power allows them to pass higher costs onto consumers.

Within the quality side of the barbell, we favor technology given the sector’s strong company balance sheets and free cash flows. Semiconductors (SOXX), for example, offer exposure to the backbone of powerful, emerging technologies, and are integral to global trade and increasingly essential to devices that allow people to work and learn remotely.

Looking at ETF flows for the last 20 years, we find that August tends to be the slowest month for flows in the equity space with outright outflows in certain areas of the market such as EM equities. Given the thin liquidity in the market, data showing a slower growth dynamic and the increasing fears over the rising number of Covid-19 cases around the world, we would not be surprised if volatility remains elevated over the next few months. We urge investors to remain invested in the markets and hedge their cyclical exposure with quality names.

Gargi Chaudhuri is head of iShares Investment Strategy Americas at BlackRock.

Why Advisors Should Consider Stock Barbells

August 6, 2021

« Previous Article

| Next Article »

Login in order to post a comment