And tech companies are even more bullish on their own stocks.

They’re betting they will eclipse the level at which the companies have agreed to convert shares during the bonds’ life, which is usually five years. Most of the tech companies that have issued convertible debt this year have paid for a “call-spread overlay,” a derivative that typically increases the price at which shares convert to double the starting price. The cost of these derivatives is steep—between 5 percent and 10 percent of proceeds, bankers and issuers estimate—but they reduce the risk of dilution that conversion triggers.

What Should Long-Duration Investors Do With This Information?

First, we have a saying in our company, which goes back to 1999 when the last big episode of “zero cost of capital” happened: “When there is going to be a hurricane in Miami, you don’t want to be in Palm Beach.” We believe investors should avoid high P/E and popular tech-related companies, which are tied in some way to the current episode.

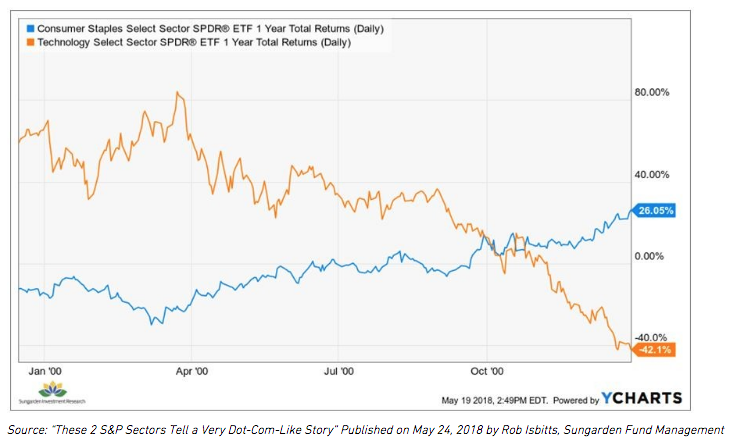

Second, look at history. In the chart below, you can see the last time that “zero cost of capital” companies sucked in most of the capital, while the most reliable staple companies saw their capital get sucked out. Our look at history comes to us thanks to a recent article by Rob Isbitts from Sungarden Investment Research. This shows how much tech dominated staples in 2000:

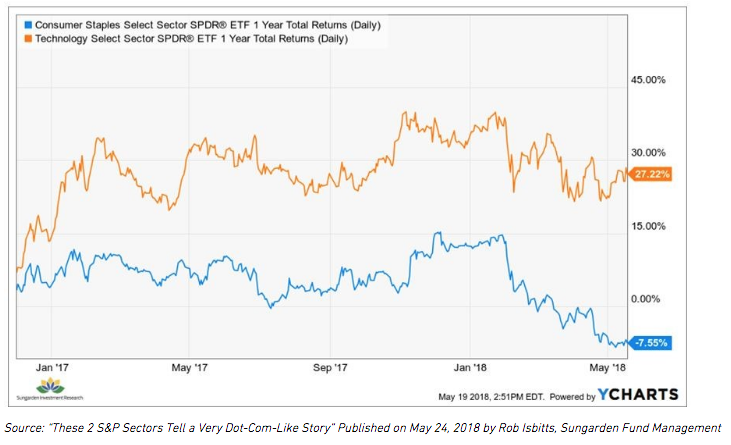

Here is what is going on today: